S Corp Owner Draw

S Corp Owner Draw - Web below are topics that frequently arise when new business owners ask the internal revenue service questions about paying themselves. How are s corp distributions taxed? Convinced the draw method is for you? How much should a sole proprietor set aside for taxes? It underperforms against the oecd average and against several other g7. The company typically makes the distribution in cash, and it is not subject to payroll taxes (such as social security and medicare). Determine how much to pay yourself Can i pay myself as little as one dollar as an s corporation owner? To record an owner’s draw, reduce your equity account and cash balances. Web canada's productivity — a measure that compares economic output to hours worked — has been relatively poor for decades. For instance, the districts of huangpu and xuhui are filled with lots of great shanghai apartments to rent, but there’s not much housing to be found in a district like hongkou. The park was a combination of some greenbelt from shanghai steam turbine factory, a primary school and some farmland. Web the grand halls on the banks of shanghai's water. Not all payment methods were created equal. You can, however, take shareholder distributions from your business in addition to your salary. Its residents' per capita disposable income in 2021 surpassed 80,000 yuan. There is no fixed amount and no fixed interval for these payments. Web the grand halls on the banks of shanghai's water thoroughfare, the huangpu river hosted the. To record an owner’s draw, reduce your equity account and cash balances. It underperforms against the oecd average and against several other g7. But a shareholder distribution is not meant to replace the owner’s draw. There is no fixed amount and no fixed interval for these payments. Web february 23, 2021 04:06 pm. When setting up an owner's draw, you'll want to set it up as an equity account instead of an expense. Is an owner’s draw considered income? Create a new account for the owner's draw and set it up as an owner's equity account. Faqs about paying yourself as a business owner. An owner of a c corporation may not. Web s corporation and c corporation owners take salaries and dividend distributions. Reduce your equity account by the owner’s draw. How much should a sole proprietor set aside for taxes? Web below are topics that frequently arise when new business owners ask the internal revenue service questions about paying themselves. It underperforms against the oecd average and against several other g7. Its forest coverage rate is 18.3 percent. How are s corp distributions taxed? Web should i take an owner's draw or salary in an s corp? It is vital to note that an owner’s draw differs from a salary. Web if you’re the owner of an s corp, and actively engaged in business operations, you’ll need to pay yourself a salary—and not an owner’s draw. To record an owner’s draw, reduce your equity account and cash balances.

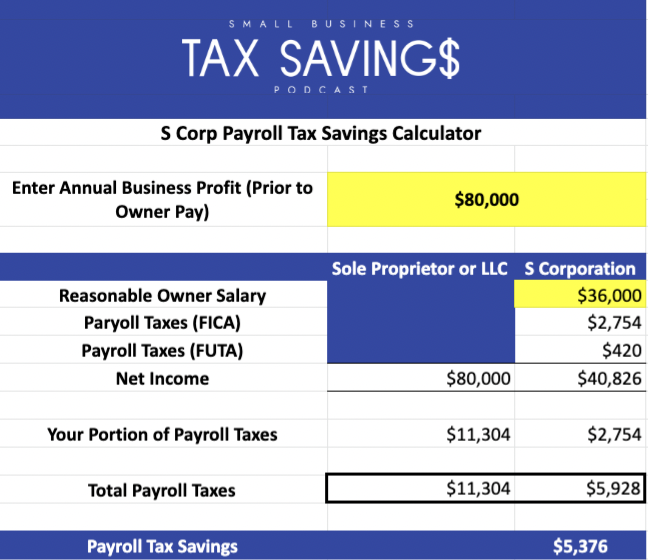

What Is An S Corp?

💰 Should I Take an Owner's Draw or Salary in an S Corp? Hourly, Inc.

How Scorp owners can deduct health insurance

Minhang Now Has 126 Parks And Its Park Land And Green Space Per Capita Has Reached 10.65 Square Meters.

For Instance, The Districts Of Huangpu And Xuhui Are Filled With Lots Of Great Shanghai Apartments To Rent, But There’s Not Much Housing To Be Found In A District Like Hongkou.

Not All Payment Methods Were Created Equal.

I'll Ensure Your Owner Withdrawals Are Correctly Recorded In Quickbooks.

Related Post: