When Do You Have To Draw From 401K

When Do You Have To Draw From 401K - Fact checked by aaron johnson. However, you can delay taking the first rmd until april 1 of the following year. Web updated on december 29, 2022. Web taking a distribution in retirement during a year where your income (including the distribution) falls below a household’s standard deduction. When it comes to when you can withdraw 401(k) funds, age 59½ is the magic. You’re not age 55 yet. Instead, your employer withholds your contribution from your paycheck before the money can be subjected to income tax. Millions of us have 401 (k) accounts, sponsored by our employers or former employers. Written by javier simon, cepf®. Most plans allow participants to withdraw funds from their 401 (k) at age 59 ½ without incurring a 10% early withdrawal tax penalty. The secure act 2.0, which passed in december 2022, increased the age from 72. Web by age 59.5 (and in some cases, age 55), you will be eligible to begin withdrawing money from your 401 (k) without having to pay a penalty tax. And hundreds of thousands, if not millions, of us actually have accounts. Web for each year after. Web for 2023, the age at which account owners must start taking required minimum distributions goes up from age 72 to age 73, so individuals born in 1951 must receive their first required minimum distribution by april 1, 2025. Understanding the rules about roth 401 (k) accounts can keep you from losing part of your retirement savings. Taking an early. Failure to do so means a penalty of 50% of the required rmd. Retirees may without penalty withdraw more than the rmd. After that, your rmds must be taken by dec. Fact checked by aaron johnson. Instead, your employer withholds your contribution from your paycheck before the money can be subjected to income tax. Web therefore, your first rmd must be taken by april 1 of the year after which you turn 73 after 2023. But you must pay taxes on the. Unlike a 401 (k) loan, the funds need not be repaid. Web for each year after your required beginning date, you must withdraw your rmd by december 31. Millions of us have 401 (k) accounts, sponsored by our employers or former employers. However, you can delay taking the first rmd until april 1 of the following year. Web with a roth 401(k), you don’t have to worry about paying taxes when it’s time to withdraw funds from the account. For the first year following the year you reach age 72, you will generally have two required distribution dates: This calculator has been updated for the 'secure act of 2019 and cares. The distributions are required to start when you turn age 72 (or 70 1/2 if you were born before 7/1/1949). Web the median 401 (k) balance for americans ages 40 to 49 is $38,600 as of the fourth quarter of 2023, according to data from fidelity investments, the nation’s largest 401 (k) provider. The rules on 401 (k) withdrawals vary depending on your age. Web by age 59.5 (and in some cases, age 55), you will be eligible to begin withdrawing money from your 401 (k) without having to pay a penalty tax. Edited by jeff white, cepf®. Outside of those specific circumstances, if you’re planning to make regular 401 (k) withdrawals in retirement, you'll have to pay taxes. And hundreds of thousands, if not millions, of us actually have accounts.

How Much Should I Have in My 401k During My 20's, 30's, 40's and 50's

The 401k Loan How to Borrow Money From Your Retirement Plan Gen X

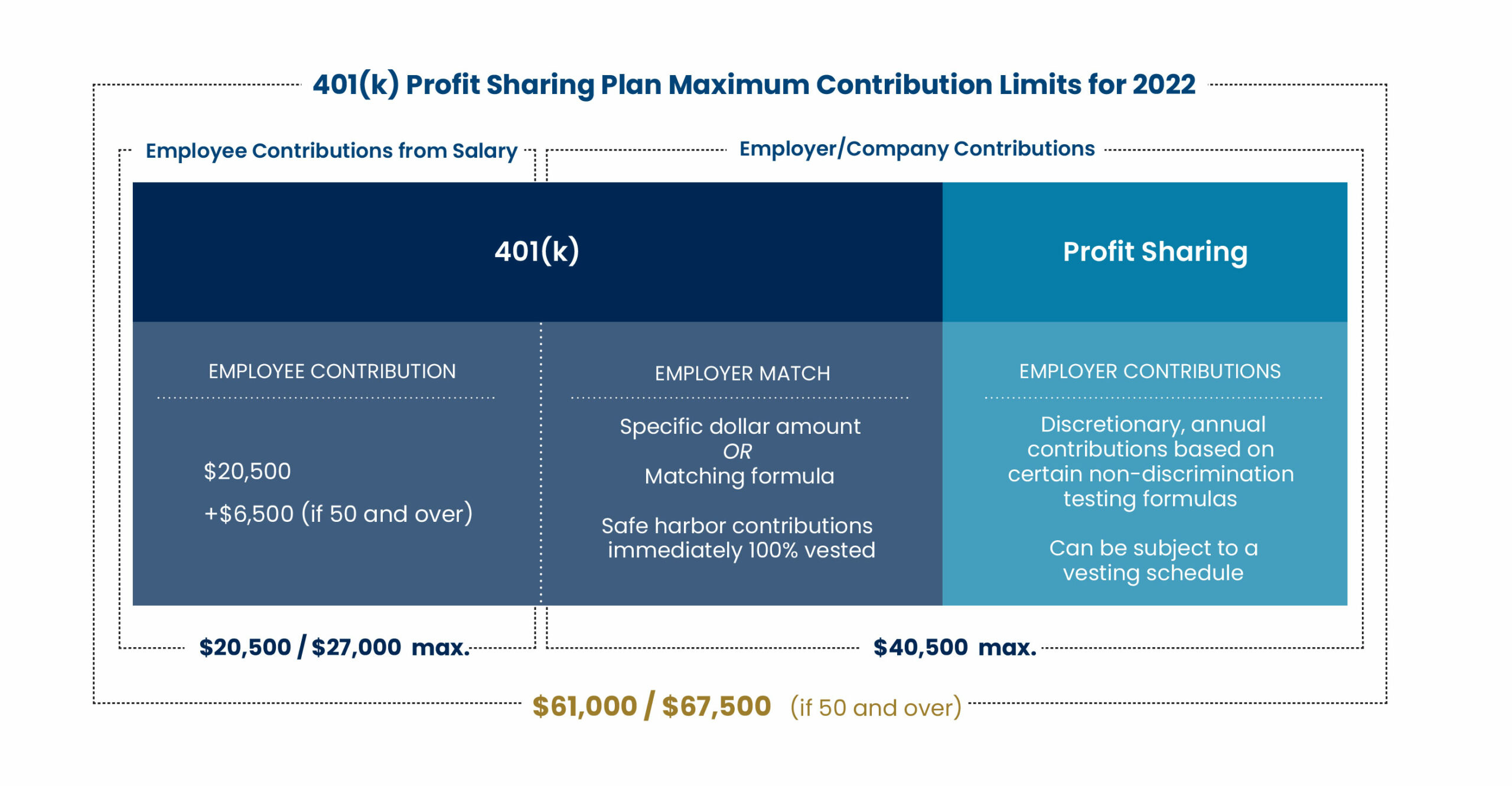

Best Guide to 401k for Business Owners 401k Small Business Owner Tips

1 If You Will Turn 72 After Jan.

Most Plans Allow Participants To Withdraw Funds From Their 401 (K) At Age 59 ½ Without Incurring A 10% Early Withdrawal Tax Penalty.

Fact Checked By Aaron Johnson.

Failure To Do So Means A Penalty Of 50% Of The Required Rmd.

Related Post: