When Can You Draw Your 401K

When Can You Draw Your 401K - Web essentially, a 401 (k) is a retirement savings plan that lets you funnel part of your paycheck into the account before taxes are taken out. Web understanding early withdrawals. If you leave your employer between the ages of 55 (actually any time during the year of your 55th birthday) and 59½, then you can withdraw. Web here’s how it works: However, early withdrawals often come with hefty penalties and tax consequences. How to make sure you don’t leave money behind. Web withdrawals before age 59 1/2. Web whether you can take regular withdrawals from your 401 (k) plan when you retire depends on the rules for your employer’s plan. When you reach 59 1/2, you can generally withdraw funds from your. A 401 (k) loan may be a better option than a. Web whether you can take regular withdrawals from your 401 (k) plan when you retire depends on the rules for your employer’s plan. Web you can either start making qualified distributions, extract a lump sum, let your account continue to accumulate earnings or roll your 401 (k) assets over to an ira. Between the taxes and penalty, your. Web funds. Cashing out your 401(k) if you leave or are fired | the motley fool However, early withdrawals often come with hefty penalties and tax consequences. Between the taxes and penalty, your. If they decide to take out funds before that. Employer matches offered by some plans make them even more potent. Web yes, you can withdraw money from your 401 (k) before age 59½. When you reach 59 1/2, you can generally withdraw funds from your. For 2024, you can stash. Web every employer's plan has different rules for 401 (k) withdrawals and loans, so find out what your plan allows. How to make sure you don’t leave money behind. When you reach 59 1/2, you can generally withdraw funds from your. To avoid penalties, you'll generally have to wait until age 59 1/2 —. If your employer allows it, it’s possible to get money out of a 401 (k) plan before age 59½. Fact checked by kirsten rohrs schmitt. How to make sure you don’t leave money behind. A 401 (k) loan may be a better option than a. Web essentially, a 401 (k) is a retirement savings plan that lets you funnel part of your paycheck into the account before taxes are taken out. Frequently asked questions (faqs) photo: For 2024, you can stash. Web here’s how it works: Web whether you can take regular withdrawals from your 401 (k) plan when you retire depends on the rules for your employer’s plan. Web generally, if you withdraw money from a 401 (k) before the plan’s normal retirement age or from an ira before turning 59 ½, you’ll pay an additional 10 percent in. However, early withdrawals often come with hefty penalties and tax consequences. Web withdrawals before age 59 1/2. Web you generally must start taking withdrawals from your 401 (k) by age 73 but can avoid this requirement if you’re still working. If you leave your employer between the ages of 55 (actually any time during the year of your 55th birthday) and 59½, then you can withdraw.

Understanding Your 401(k) Options One Smart Dollar

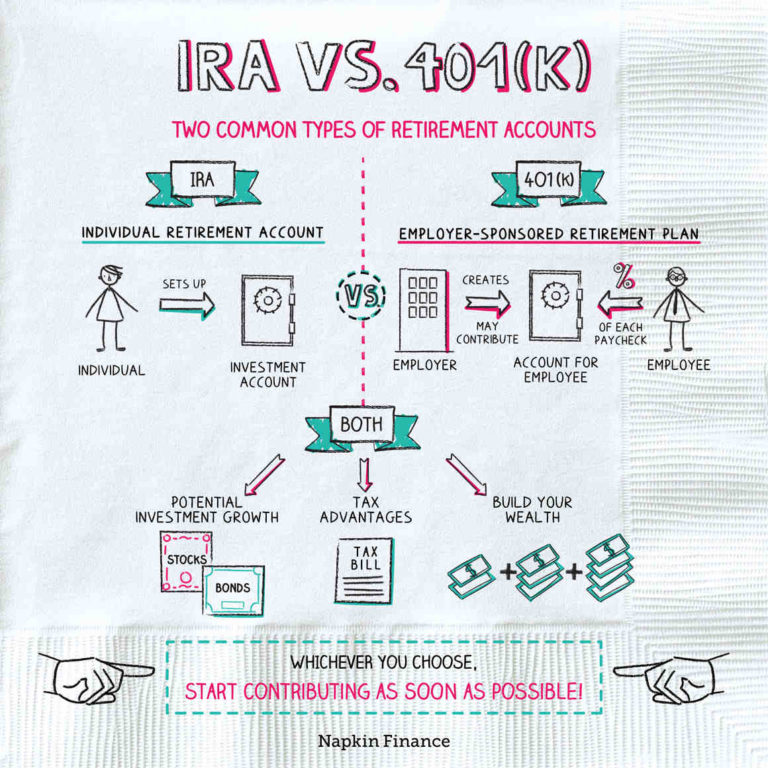

Can I have a Roth IRA and a 401K? Investment & Finance News

When Can I Draw From My 401k Men's Complete Life

Web You Can Either Start Making Qualified Distributions, Extract A Lump Sum, Let Your Account Continue To Accumulate Earnings Or Roll Your 401 (K) Assets Over To An Ira.

What Happens To A 401 (K) When You Quit A Job?

Web Yes, You Can Withdraw Money From Your 401 (K) Before Age 59½.

Withdrawals After Age 59 1/2.

Related Post: