When Can You Draw On Ira

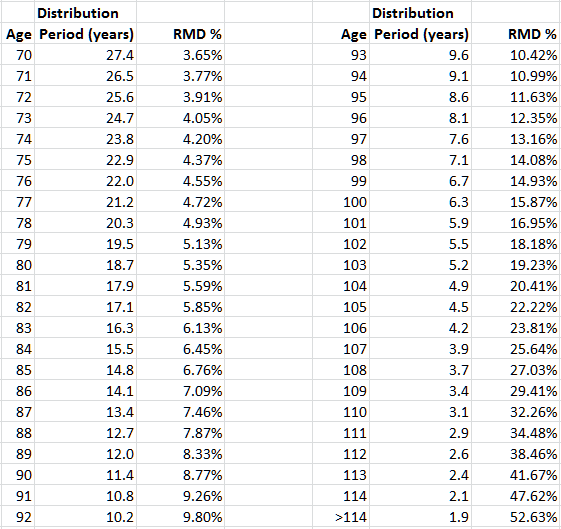

When Can You Draw On Ira - But you can only pull the earnings out of a roth ira after age 59 1/2 and after owning the account for at least. You generally must start taking withdrawals from your traditional ira, sep ira, simple ira, and retirement plan accounts when you reach age 72 (73 if you reach age 72 after dec. Once you turn age 59 1/2, you can withdraw any amount from your ira without having to pay the 10% penalty. Usa.gov has a free retirement planning tool. 1 how big of a deal is it? Early withdrawals from an ira. While tapping your ira might get you into a home sooner, it could leave. Penalties, fees and taxes on ira withdrawals. You can choose to take the payments monthly, quarterly, or annually. Early withdrawal of earnings can lead to a 10% penalty and income. You can choose to take the payments monthly, quarterly, or annually. But if you own a traditional ira, you must take your first required minimum distribution (rmd) by april 1 of the year following the year you reach rmd age. There are exceptions to the 10 percent penalty, such as using ira funds to pay your medical insurance premium after. Web you must start these withdrawals by april 1 of the year following your 72nd birthday, then by dec. Web once you reach age 59½, you can withdraw funds from your traditional ira without restrictions or penalties. Before you withdraw, we’ll help you understand below how your age and other factors impact the way the irs treats your withdrawal. Penalties,. Department of labor (dol) has a. Early withdrawal of earnings can lead to a 10% penalty and income. The rmd rules require individuals to take withdrawals from their iras (including simple iras and sep iras) every year once they reach age 72 (73 if the account owner reaches age 72 in 2023 or later), even if they're still employed. There. Web the magic ages of 59 1/2 and 70 1/2. Usa.gov has a free retirement planning tool. Web ira withdrawals taken before age 59 1/2 typically incur a 10% penalty. Before you withdraw, we’ll help you understand below how your age and other factors impact the way the irs treats your withdrawal. While tapping your ira might get you into a home sooner, it could leave. July 21, 2023, at 9:21 a.m. If you’re under age 59½ and need to withdraw from your ira for whatever reason, you can—but it’s important to know what to expect in potential taxes and penalties, along with possible exceptions and other options for cash. A 10% additional tax generally applies if you withdraw ira or retirement plan assets before you reach age 59½, unless you qualify for another exception to the tax. But you can only pull the earnings out of a roth ira after age 59 1/2 and after owning the account for at least. There are exceptions to the 10 percent penalty, such as using ira funds to pay your medical insurance premium after a job loss. Web once you reach age 59½, you can withdraw funds from your traditional ira without restrictions or penalties. Web withdrawals from simple iras. There are five main types of ira withdrawals: Web there are a few rules for taking money out of your 401 (k) or ira account before you reach retirement age. Need money for unexpected expenses? Are you under age 59 ½ and want to take an ira withdrawal?

COMO DIBUJAR A IRA DE INSIDE OUT PASO A PASO Dibujos kawaii faciles

Drawing Down Your IRA What You Can Expect Seeking Alpha

_into_a_Roth_IRA-1.png?width=3360&height=1890&name=Signs_to_Roll_your_401_(k)_into_a_Roth_IRA-1.png)

Rollover 401(k) to Roth IRA Rules, Pros, Cons, Signs, & How to Rollover

Web You Must Start These Withdrawals By April 1 Of The Year Following Your 72Nd Birthday, Then By Dec.

Early Withdrawals From An Ira.

You Can Choose To Take The Payments Monthly, Quarterly, Or Annually.

1 How Big Of A Deal Is It?

Related Post: