When Can You Draw From An Ira

When Can You Draw From An Ira - You'll need to take mandatory distributions from traditional iras beginning the year youn turn 73. There is no need to show a hardship to take a distribution. Web you can withdraw roth individual retirement account (ira) contributions at any time. 1 of the year you do the conversion. Web ira beneficiaries don’t have to take an rmd this year. You can, however, name a trust as the beneficiary of your ira and dictate. Web what if you want to withdraw money from a traditional ira before age 59½? While tapping your ira might get you into a. Web once you reach age 59½, you can withdraw funds from your traditional ira without restrictions or penalties. Web are you age 73* or older and looking to take a required minimum distribution (rmd)? There is no need to show a hardship to take a distribution. Roth iras don't have rmds. You've reached that magic age when the irs requires you to take annual ira withdrawals. Web simple ira withdrawal and transfer rules. Generally, you have to pay income tax on any amount you withdraw from your simple ira. So if you convert $5,000 from a traditional ira to a roth ira on sept. However, you may have to pay taxes and penalties on earnings in. Web you generally must start taking withdrawals from your traditional ira, sep ira, simple ira, and retirement plan accounts when you reach age 72 (73 if you reach age 72 after. Web ira. Once you turn age 59 1/2, you can withdraw any amount from your ira without having to pay the 10% penalty. Web july 21, 2023, at 9:21 a.m. Web simple ira withdrawal and transfer rules. Web you cannot put your individual retirement account (ira) in a trust while you are living. Roth iras don't have rmds. Irs rules say that the money must be withdrawn when you are at an age where you stop working for good. If you withdraw roth ira earnings before age 59½, a 10% penalty usually. Web generally, early withdrawal from an individual retirement account (ira) prior to age 59½ is subject to being included in gross income plus a 10 percent. Web once you reach age 59½, you can withdraw funds from your traditional ira without restrictions or penalties. However, you may have to pay taxes and penalties on earnings in. Web what if you want to withdraw money from a traditional ira before age 59½? You'll need to take mandatory distributions from traditional iras beginning the year youn turn 73. Web simple ira withdrawal and transfer rules. Web you cannot put your individual retirement account (ira) in a trust while you are living. Web age 59 ½ and under. There is no need to show a hardship to take a distribution. Roth iras don't have rmds. Once you turn age 59 1/2, you can withdraw any amount from your ira without having to pay the 10% penalty. You've reached that magic age when the irs requires you to take annual ira withdrawals. You can, however, name a trust as the beneficiary of your ira and dictate. But you can only pull the earnings out of a roth ira after age 59 1/2 and after owning.Roth IRA Withdrawal Rules and Penalties First Finance News

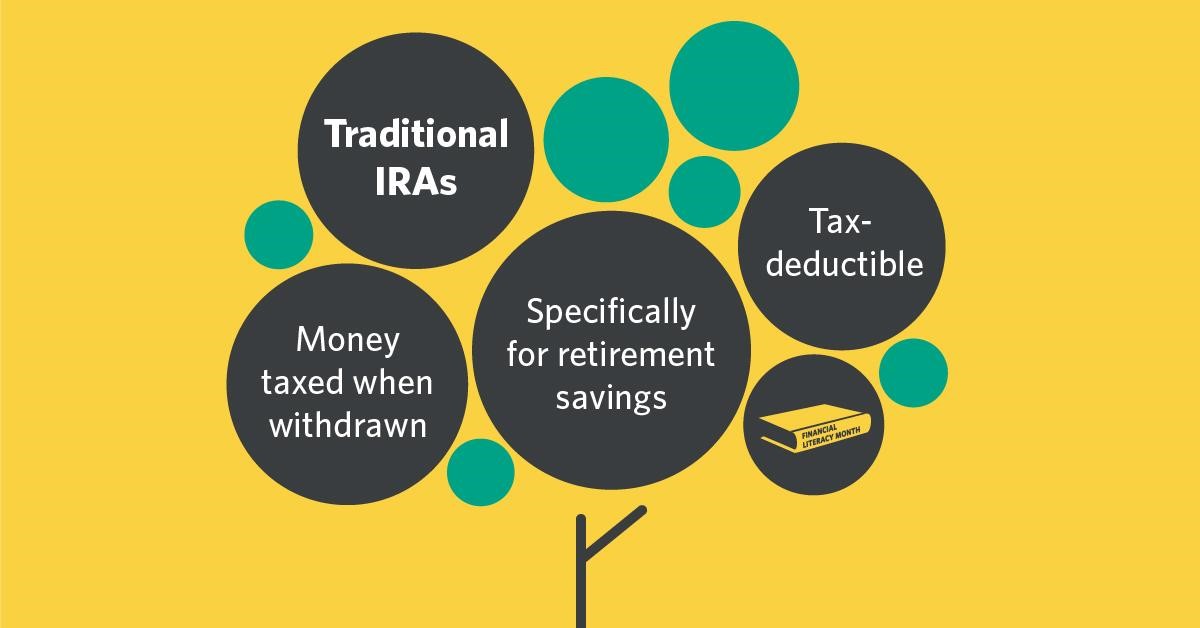

What is a Traditional IRA Edward Jones

Roth IRA Withdrawal Rules and Penalties First Finance News

But After That, You Can Wait Until December 31 Of Each Year.

Web Ira Beneficiaries Don’t Have To Take An Rmd This Year.

Web Ira Withdrawals Taken Before Age 59 1/2 Typically Incur A 10% Penalty.

1 Of The Year You Do The Conversion.

Related Post: