When Can You Draw From A 401K

When Can You Draw From A 401K - If that happens, you might need to begin taking distributions from your 401 (k). If you find yourself needing to tap into your retirement funds early, here are rules to be aware of and options to consider. Most plans allow participants to withdraw funds from their 401 (k) at age 59 ½ without incurring a 10% early withdrawal tax penalty. A hardship withdrawal from a 401 (k) retirement account is for large, unexpected expenses. Let’s take a closer look at the rules related to the age at which you can withdraw from 401 (k) plans. Web as a general rule, if you withdraw funds before age 59 ½, you’ll trigger an irs tax penalty of 10%. Web the median 401 (k) balance for americans ages 40 to 49 is $38,600 as of the fourth quarter of 2023, according to data from fidelity investments, the nation’s largest 401 (k) provider. If you are under age 59½, in most cases you will incur a 10% early withdrawal penalty and owe. That means you will pay the regular income tax rates on your distributions. This is known as the rule of 55. A 401(k) account alone may not help you save as much as you need for retirement.; Web you generally must start taking withdrawals from your 401 (k) by age 73 but can avoid this requirement if you’re still working. You’ll need to speak with someone at your company’s human resources department to see if this option is available and how. You pay taxes only on the money you withdraw. Web whether you can take regular withdrawals from your 401 (k) plan when you retire depends on the rules for your employer’s plan. If you are under age 59½, in most cases you will incur a 10% early withdrawal penalty and owe. Unfortunately, there's usually a 10% penalty—on top of the. Unlike a 401 (k) loan, the funds need not be repaid. Web can you withdraw money from a 401 (k) early? You’ll simply need to contact your plan administrator or log into your account online and request a withdrawal. However, early withdrawals often come with hefty penalties and tax consequences. For 401 (k) withdrawals, the threshold is. You can contribute to a roth ira (a type of individual retirement plan) and a 401 (k) (a workplace retirement plan) at the same time. (they may be able to. Web understanding early withdrawals. Web first, not all employers allow early 401 (k) withdrawals. Early withdrawals occur if you receive money from a 401 (k) before age 59 1/2. A 401(k) account alone may not help you save as much as you need for retirement.; This is known as the rule of 55. You’ll need to speak with someone at your company’s human resources department to see if this option is available and how the process. Let’s take a closer look at the rules related to the age at which you can withdraw from 401 (k) plans. While you’ve deferred taxes until now, these distributions are now taxed as regular income. You pay taxes only on the money you withdraw. That means you will pay the regular income tax rates on your distributions. This year, you can contribute up to $23,000 to a 401(k) and $7,000 to an i.r.a. Web you can begin to withdraw from your 401 (k) without penalty when you reach age 55 through age 59½. Most plans allow participants to withdraw funds from their 401 (k) at age 59 ½ without incurring a 10% early withdrawal tax penalty. Unlike a 401 (k) loan, the funds need not be repaid.

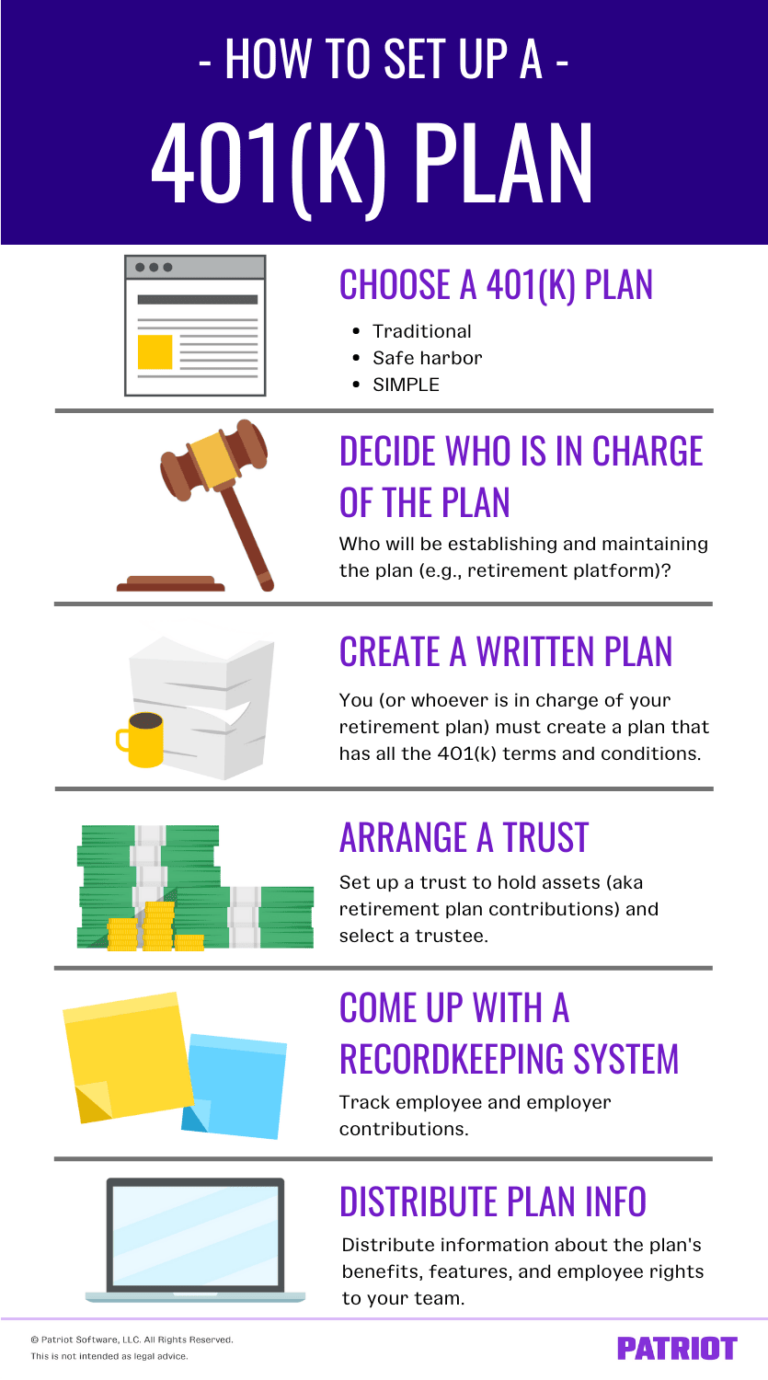

How to Set up a 401(k) Plan for Small Business Steps & More

3 Ways to Withdraw from Your 401K wikiHow

When Can I Draw From My 401k Men's Complete Life

Web At What Age Should I Start 401 (K) Withdrawals?

In Most, But Not All, Circumstances, This Triggers An Early Withdrawal Penalty Of.

Web The Irs Rule Of 55 Recognizes You Might Leave Or Lose Your Job Before You Reach Age 59½.

But If You’re Withdrawing Roth Funds, You May Not Have To Pay Taxes On Your Contributions.

Related Post: