When Can You Draw From 401K

When Can You Draw From 401K - Be at least age 55 or older. Most plans allow participants to withdraw funds from their 401 (k) at age 59 ½ without incurring a 10% early withdrawal tax penalty. Web as a general rule, if you withdraw funds before age 59 ½, you’ll trigger an irs tax penalty of 10%. A hardship withdrawal avoids a penalty charge but not taxes. While you’ve deferred taxes until now, these distributions are now taxed as regular. Web age 59½ is the earliest you can withdraw funds from an ira account and pay no penalty. A 401 (k) loan may be a better option than a traditional hardship. Web it expects to report to congress with recommendations by the end of 2025, ms. Web over the course of a year, an extra $50 per week would mean $2,600 per year in savings, which you could invest in the invesco qqq trust. According to the ssa, if you’re younger than full retirement age during all of 2024, it must deduct $1. Web however, you may need to take some proactive steps in order to retire comfortably. Advice & guidanceaccess to advisors Web you can generally take 401(k) withdrawals before age 59½ if you become disabled, you have a severance from employment, your 401(k) plan is terminated or you experience. If that happens, you might need to begin taking distributions from your. Web for 2024, the earnings limit to collect social security before fra is $22,320. Web you can generally take 401(k) withdrawals before age 59½ if you become disabled, you have a severance from employment, your 401(k) plan is terminated or you experience. The median 401 (k) balance for americans ages 40 to 49 is $38,600 as of the fourth quarter.. The internal revenue service (irs) has set the. Web it expects to report to congress with recommendations by the end of 2025, ms. Web every employer's plan has different rules for 401 (k) withdrawals and loans, so find out what your plan allows. Web you can make a 401 (k) withdrawal at any age, but doing so before age 59. Web every employer's plan has different rules for 401 (k) withdrawals and loans, so find out what your plan allows. Web 401 (k) plans are meant to help you save for retirement, so if you take 401 (k) withdrawals before age 59 1/2, you'll generally owe a 10% early withdrawal penalty on top of. Web typically, account holders can withdraw money from their 401 (k) without penalties when they reach the age of 59½. 401 (k) how to make a 401 (k) hardship withdrawal. A 401 (k) early withdrawal is any money you take out from your retirement account before you’ve reached federal retirement age, which is currently 59 ½. The good news is that there’s a way to take your distributions a few years early. Web you can make a 401 (k) withdrawal at any age, but doing so before age 59 ½ could trigger a 10% early distribution tax, on top of ordinary income taxes. You can access funds from an old 401(k) plan after you reach age 59½ even if you. Web after retirement you can start withdrawing the money you have accumulated over the years in your 401 (k). Web you generally must start taking withdrawals from your traditional ira, sep ira, simple ira, and retirement plan accounts when you reach age 72 (73 if you reach age 72 after. Web as a general rule, if you withdraw funds before age 59 ½, you’ll trigger an irs tax penalty of 10%. Web a withdrawal you make from a 401 (k) after you retire is officially known as a distribution. In most, but not all, circumstances, this triggers an early. Be at least age 55 or older. A 401 (k) loan may be a better option than a traditional hardship. However, a number of rules govern retirees’ 401 (k) distributions.

When Can I Draw From My 401k Men's Complete Life

:max_bytes(150000):strip_icc()/can-i-withdraw-money-from-my-401-k-before-i-retire-2894181-FINAL-4f77dfcb474e446bb27fb9723e9f0881.png)

Can I Withdraw Money from My 401(k) Before I Retire?

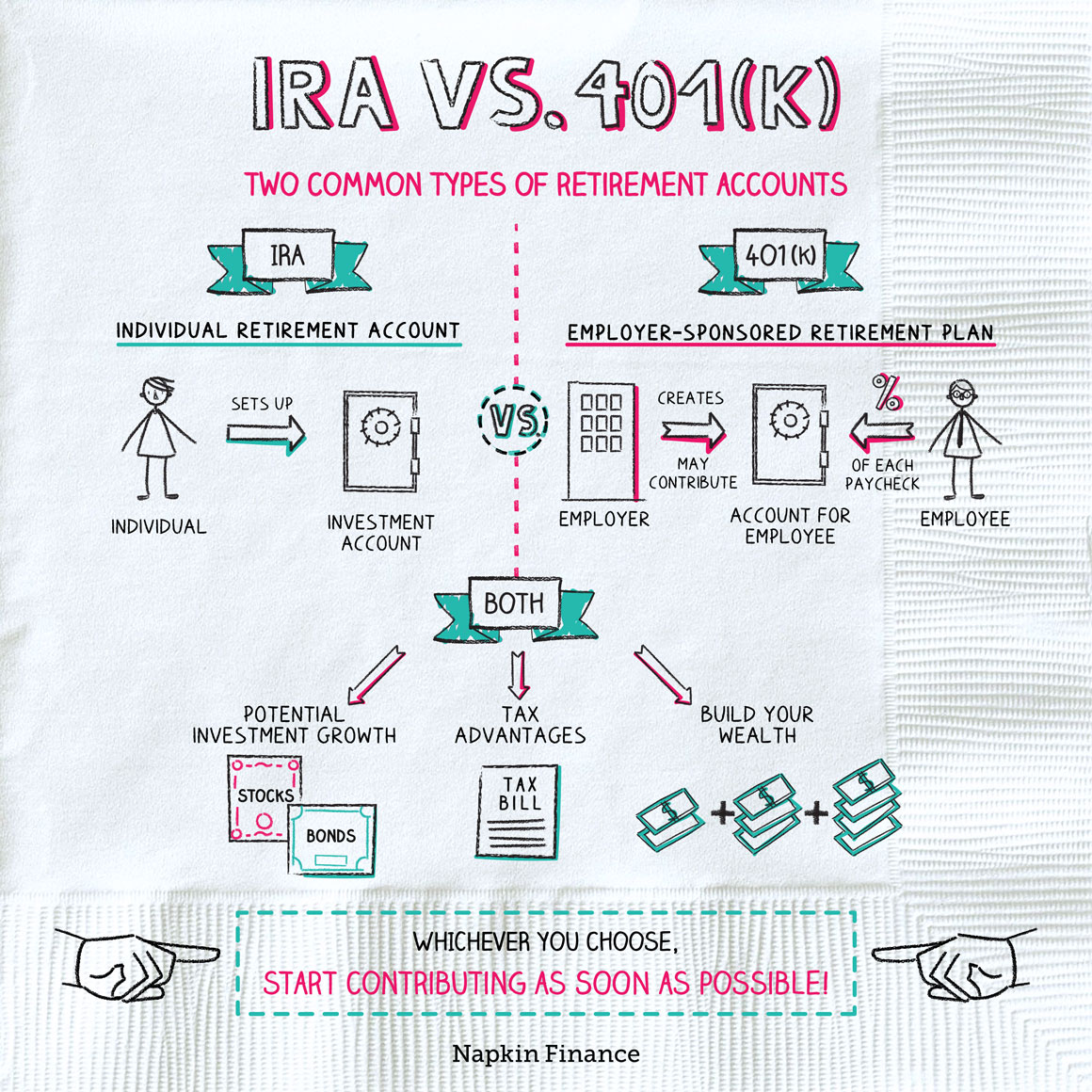

What is 401K? IRA vs 401K Retirement Answers from Napkin Finance

Web Here’s How It Works:

Learn More.learn Finance Easily.master The Fundamentals.free Animation Videos.

Web You Can Withdraw $600.25 At The Beginning Of Each Month To Deplete Your Expected Balance By The End Of Your Retirement.

Web By Age 59.5 (And In Some Cases, Age 55), You Will Be Eligible To Begin Withdrawing Money From Your 401 (K) Without Having To Pay A Penalty Tax.

Related Post: