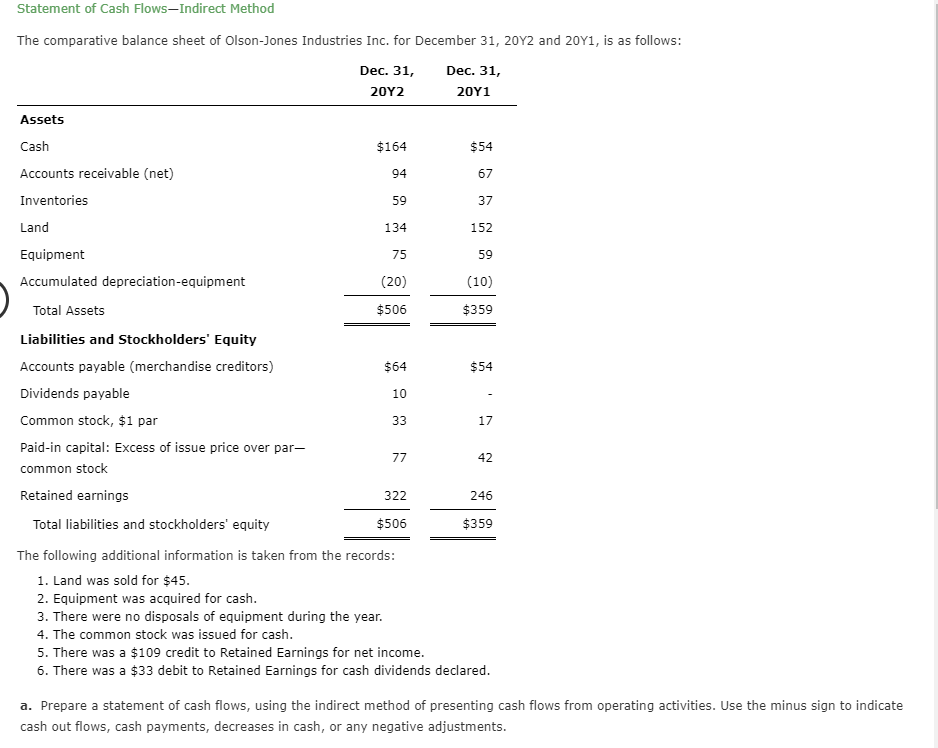

Salary Draw

Salary Draw - But how do you know which one (or both) is an option for your business? Understand how owner’s equity factors into your decision. Treat yourself like an employee and pay yourself a salary, or take an owner’s draw. To record an owner’s draw, reduce your equity account and cash balances. Meaning, the money paid to the salesperson is similar to a salary. There is no fixed amount and no fixed interval for these payments. Collins cobuild advanced learner’s dictionary. Web you can pay straight commission, salary with a bonus at the end of the year, or a base salary with some commission. Web earning a salary includes the following advantages: Can you deduct an owner’s draw? Legally, it would be like suing an hourly employee for wages paid. How to pay yourself as a business owner by business type. That’s because you can expect the same amount of money each paycheck and plan accordingly. How much should a sole proprietor set aside for taxes? The parties will then negotiate different commission percentages for sales made against. This means it must be paid every pay period and vests upon the employee terminating (voluntarily or involuntarily). In this article, we’ll talk about one way to do payroll for sales people,. Web earning a salary includes the following advantages: The draw amount is the total that the employer expects the salesperson to make through. To either take an owner’s. Understand tax and compliance implications. Web owner’s draw involves drawing discretionary amounts of money from your business to pay yourself. If you're the owner of a company, you’re probably getting paid somehow. Each has slightly different tax implications, so you’ll want to weigh your options carefully, based on the business structure you’re operating as. When you enter the workforce, you. It guarantees a set amount of advanced income for each paycheck. Web a commission draw, also known as a draw against commission, is one of the most common ways to pay commission to salespeople. For example, an employee receives a draw of $600 per week, and you give out the remaining commissions at the end of every month. Web as with any salary, a draw is considered wages. When you give the employee their draw, subtract it from their total commissions. A draw can be considered a cash advance for sales reps and an incentive for boosting sales performance. Can you deduct an owner’s draw? The more you sell, the more money you'll make. How much should a sole proprietor set aside for taxes? If i’m a partner of coffee connoisseurs. When you enter the workforce, you may earn a set salary each year as opposed to receiving hourly pay. Web you can pay straight commission, salary with a bonus at the end of the year, or a base salary with some commission. In this article, we’ll talk about one way to do payroll for sales people,. If you're the owner of a company, you’re probably getting paid somehow. To help answer this question, we’ve broken down the differences between an owner’s draw and a salary, using patty as an example. How are s corp distributions.

Salary or Draw How to Pay Yourself as a Business Owner Online Accounting

![]()

Salary Vector Icon 290529 Vector Art at Vecteezy

Salary Drawing at GetDrawings Free download

This Form Of Payment Is A Slightly Different Tactic From One Where An Employee Is Given A Base Pay.

Collins Cobuild Advanced Learner’s Dictionary.

Faqs About Paying Yourself As A Business Owner.

After The Employee's Sales Figures For The Month Are Calculated, The Employee May Keep Any Amount Of Commission He Earns That Exceeds The Draw Amount.

Related Post: