S Corp Owners Draw

S Corp Owners Draw - Web since an s corp is structured as a corporation (which is a legal entity in its own right), the profits belong to the corporation and owner's draws are not available to owners of an s corp. The company typically makes the distribution in cash, and it is not subject to payroll taxes (such as social security and medicare). Convinced the draw method is for you? A full guide on how to calculate income tax on a pay. Its residents' per capita disposable income in 2021 surpassed 80,000 yuan. Do you have to pay taxes on owner’s draw? An owner of a sole proprietorship, partnership, llc, or s corporation may take an owner's draw; Reduce your basis (ownership interest) in the company because they are equity transactions on. They have different tax implications and are reserved for different types of businesses. A salary payment is a fixed amount of pay at a set interval, similar to any other type of employee. The company typically makes the distribution in cash, and it is not subject to payroll taxes (such as social security and medicare). You qualify for the 20% deduction only if your total taxable income for the year is less than $157,500 (single) or $315,000 (married, filing jointly). An owner of a sole proprietorship, partnership, llc, or s corporation may take. Let’s see if we can draw you in a little further. I'll ensure your owner withdrawals are correctly recorded in quickbooks. The owner’s draw method and the salary method. However, a draw is taxable as income on the owner’s personal tax return. How does an owner’s draw work based on type of business? How an owner’s draw affects taxes. The company typically makes the distribution in cash, and it is not subject to payroll taxes (such as social security and medicare). The park was a combination of some greenbelt from shanghai steam turbine factory, a primary school and some farmland. They have different tax implications and are reserved for different types of businesses.. Web february 23, 2021 04:06 pm. Web also sometimes referred to as a draw, an owner’s draw is where you as the owner of your business takes a certain amount of money from your business, so that you can use it for your own purposes. Any net profit that’s not used to pay owner salaries or taken out in a draw is taxed at the corporate tax rate, which is usually lower than the personal income tax rate. Some business owners pay themselves a salary, while others compensate themselves with an owner’s draw. Web owner’s draw in an s corp. An owner of a sole proprietorship, partnership, llc, or s corporation may take an owner's draw; Web understanding the difference between an owner’s draw vs. How does an owner’s draw work based on type of business? When setting up an owner's draw, you'll want to set it up as an equity account instead of an expense. The owner’s draw method and the salary method. Reduce your basis (ownership interest) in the company because they are equity transactions on. The park was a combination of some greenbelt from shanghai steam turbine factory, a primary school and some farmland. Web an owner's draw is an amount of money an owner takes out of a business, usually by writing a check. Do you have to pay taxes on owner’s draw? Web in an s corp, the owner’s salary is considered a business expense, just like paying any other employee. An owner’s draw is not taxable on the business’s income.

How Scorp owners can deduct health insurance

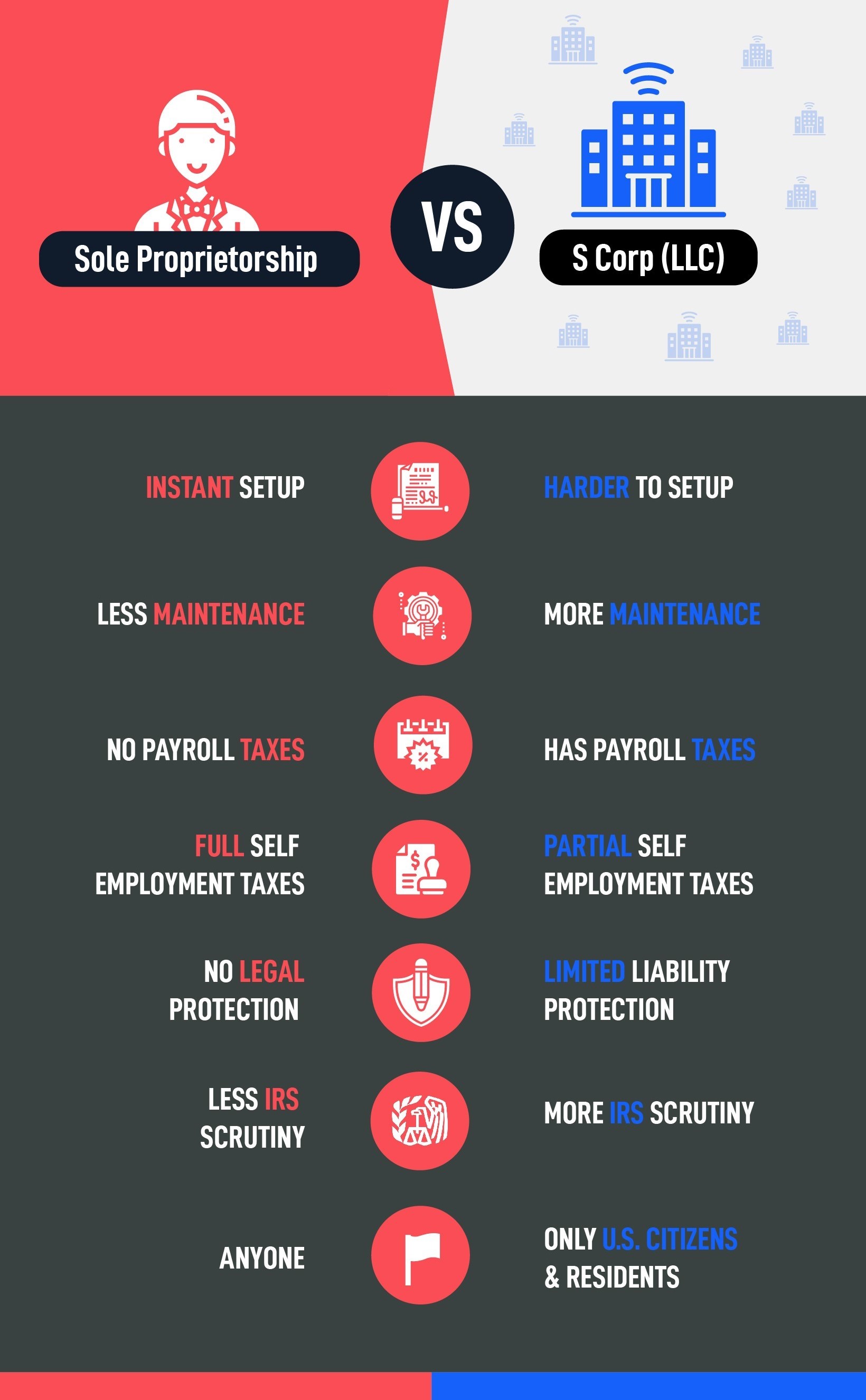

S Corp vs Sole Proprietorship Pros & Cons (Infographic 🆚)

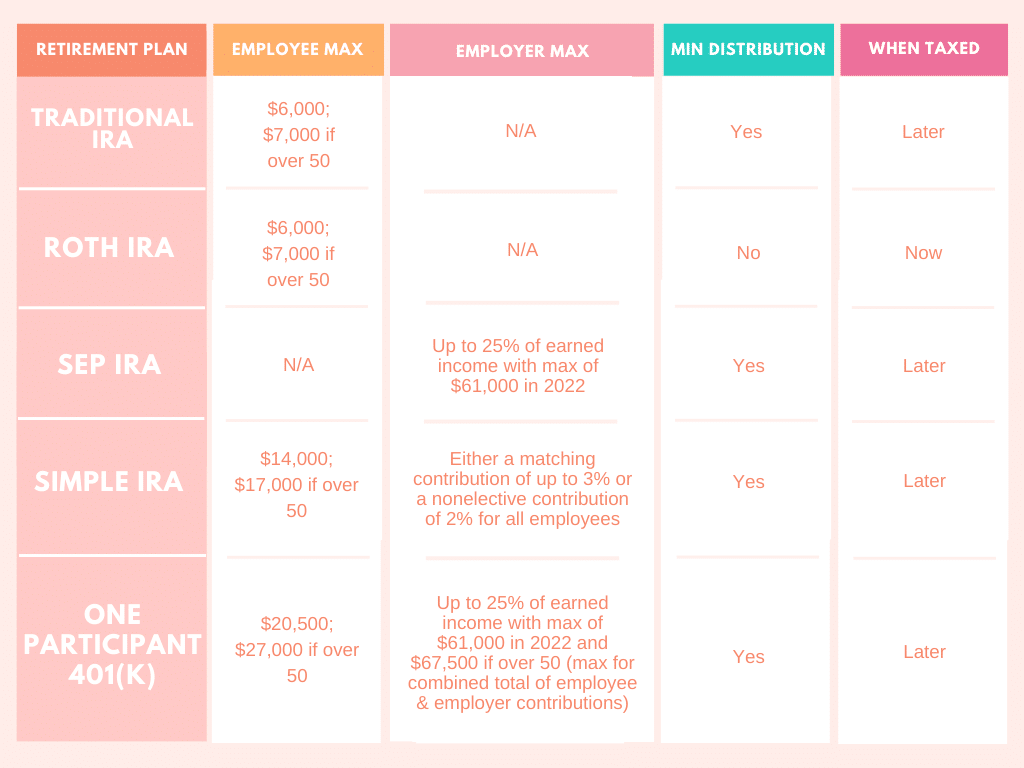

Retirement Account Options for the SCorp Owner

I'll Ensure Your Owner Withdrawals Are Correctly Recorded In Quickbooks.

For Sole Proprietors, An Owner’s Draw Is The Only Option For Payment.

This Could Be Taken As A Single Sum, Or Set Up As A Regular Payment.

Some Of These Districts Are Much More Popular With Expats Than Others.

Related Post: