Owners Drawings

Owners Drawings - Finished seventh with enforceable in 2020. Web an owner's draw is a distribution of funds taken by the owner of a sole proprietorship or partnership. Web we have written a few articles on owners drawings, in particular dealing with interest charges and tax. It's considered an owner's draw if you transfer money from your business bank account to your personal account and use that money for personal expenses. First derby for the others. David bernsen, tony holmes, michael holmes, norevale farm (leo and sarah dooley). These draws can be in the form of cash or other assets, such as bonds. Well as it sounds it’s essentially the owner taking money out of their business in lieu of a salary. Learn all about owner's draws: This is a contra equity account that is paired with and offsets the owner's capital account. Learn all about owner's draws: You should only take an owner's draw if your business profits. An owner of a c corporation may not. Typically, owners will use this method for paying themselves instead of taking a regular salary, although an owner's draw can also be taken in addition to receiving a regular salary from the business. Jan 26, 2018. An owner of a sole proprietorship, partnership, llc, or s corporation may take an owner's draw; Web also known as the owner’s draw, the draw method is when the sole proprietor or partner in a partnership takes company money for personal use. The money is used for personal. Patty could withdraw profits from her business or take out funds that. Web starting a business. The account in which the draws are recorded is a contra owner’s capital account or contra owner’s equity account since its debit balance is contrary to the normal credit balance of the owner’s equity or capital account. Taking a draw when your business is not profitable can put your. Web an owner’s drawing account, often simply. Web also known as the owner’s draw, the draw method is when the sole proprietor or partner in a partnership takes company money for personal use. A draw lowers the owner's equity in the business. Web starting a business. It's considered an owner's draw if you transfer money from your business bank account to your personal account and use that money for personal expenses. This is a contra equity account that is paired with and offsets the owner's capital account. This method of payment is common across various business structures such as sole proprietorships, partnerships, limited liability companies (llcs), and s corporations. How do business owners get paid? Web owner’s draw or owner’s withdrawal is an account used to track when funds are taken out of the business by the business owner for personal use. An equity account contains different. Business owners may use an owner’s draw rather than taking a salary from the business. Erin is an art historian and lawyer and an amateur art detective. Web an owner’s draw refers to an owner taking funds out of the business for personal use. When done correctly, taking an owner’s draw does not result in you owing more or less. Web what is an owner’s draw? Web taking an owner’s draw is a relatively simple process since it should not trigger a “taxable event.”. Web an owner's draw is money taken out by a business owner from the company for personal use.

Owners Drawing at Explore collection of Owners Drawing

Owners Drawing at Explore collection of Owners Drawing

Dog and Owner Portrait Custom Line Drawing From Photo Line Etsy UK

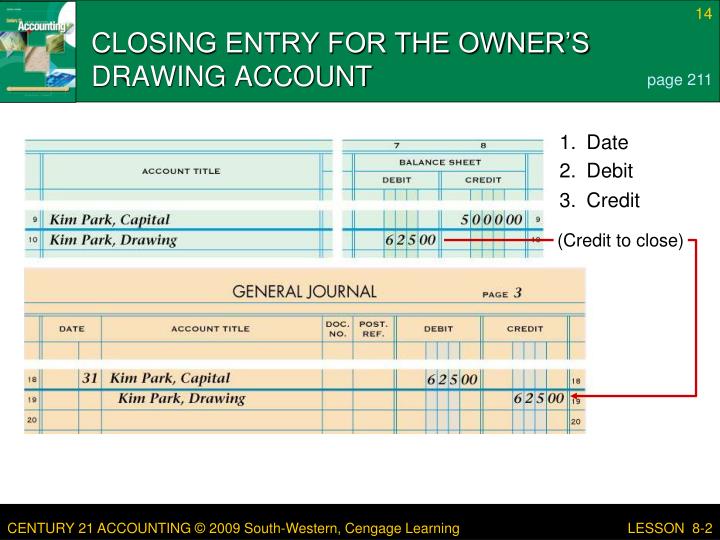

The Account In Which The Draws Are Recorded Is A Contra Owner’s Capital Account Or Contra Owner’s Equity Account Since Its Debit Balance Is Contrary To The Normal Credit Balance Of The Owner’s Equity Or Capital Account.

Jan 26, 2018 • 4 Minutes.

Finished Seventh With Enforceable In 2020.

It Is An Equity Account From Which The Money Gets Deducted.

Related Post: