Owners Drawings Debit Or Credit

Owners Drawings Debit Or Credit - Web owner’s draws represent the direct withdrawal of funds or assets for the business owner’s personal use or expenses. Web owner’s draw or owner’s withdrawal is an account used to track when funds are taken out of the business by the business owner for personal use. Web debits are always entered on the left side of a journal entry. Web owner’s draws are withdrawals of a sole proprietorship’s cash or other assets made by the owner for the owner’s personal use. Web the owner's drawing account is used to record the amounts withdrawn from a sole proprietorship by its owner. Is owner’s drawing account debit or credit? This method of payment is. Web a drawing account is an accounting record maintained to track money withdrawn from a business by its owners. This is a contra equity account that is paired with and. The account in which the draws are recorded is a. This method of payment is. Web drawing accounts serve as a contra account to owner's equity, with debits in drawing accounts offset by credits in cash accounts. Web also known as the owner's draw, the draw method is when the sole proprietor or partner in a partnership takes company money for personal use. Web the meaning of drawing in accounts. Web a drawing account is an accounting record maintained to track money withdrawn from a business by its owners. This is a contra equity account that is paired with and. A credit is an accounting transaction that increases a liability account such as loans payable, or. Usually, owners have the right to do so due to their ownership of the.. Web the drawing account’s debit balance is contrary to the expected credit balance of an owner’s equity account because owner withdrawals represent a reduction. This is a contra equity account that is paired with and. So, drawings are simply personal expenses and not business expenses. A drawing account is used primarily for. Web owner’s draw or owner’s withdrawal is an. Web owner withdrawal also referred to as drawings, is when an entity’s owner withdraws assets from it. Web definition of drawings drawings are the withdrawals of a sole proprietorship's business assets by the owner for the owner's personal use. Web owner’s draw or owner’s withdrawal is an account used to track when funds are taken out of the business by the business owner for personal use. Business owners may use an. Web in either circumstance, owners are held responsible for the transaction. A credit is an accounting transaction that increases a liability account such as loans payable, or. Web what are drawings and its journal entry (cash, goods)? This method of payment is. So, drawings are simply personal expenses and not business expenses. From this, you can easily apply the same. Web the meaning of drawing in accounts is the record kept by a business owner or accountant that shows how much money has been withdrawn by business. We usually record owner’s draws as. Web an owner’s draw is a financial mechanism through which business owners can withdraw funds from their company for personal use. Web a drawing account, sometimes referred to as a “draw account” or “owner’s draw,” is a critical accounting record used to track money and other assets withdrawn. Web a drawing account is an accounting record maintained to track money withdrawn from a business by its owners. A drawing account is used primarily for.

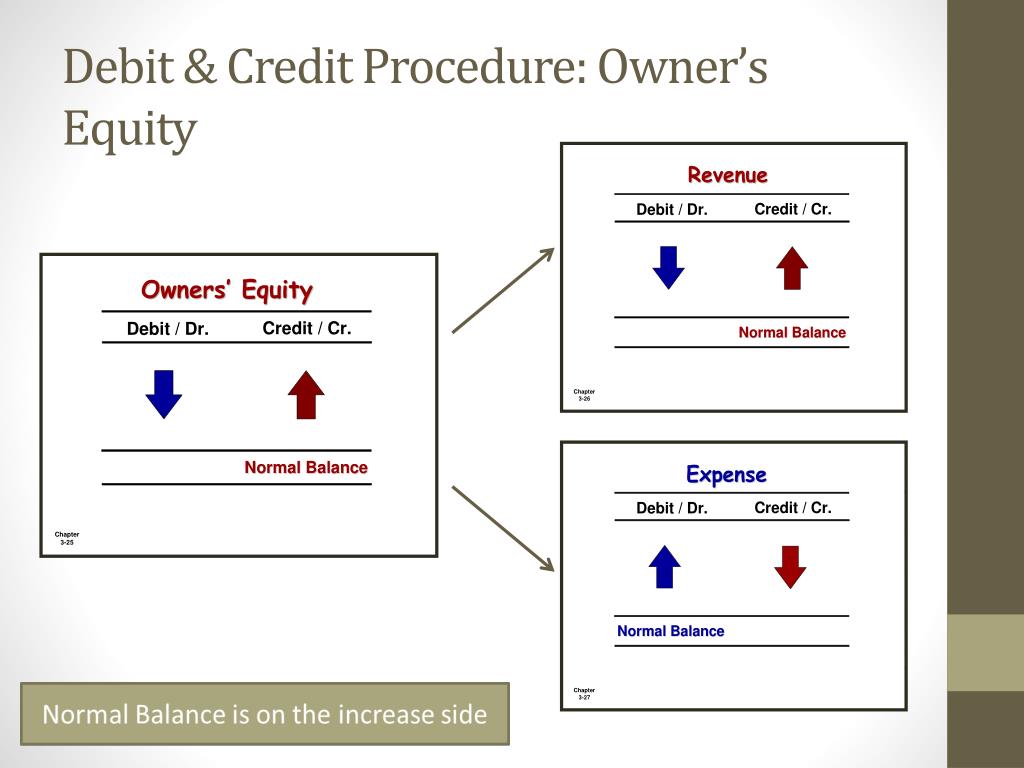

Debits and Credits Cheat Sheet • 365 Financial Analyst

PPT Chapter 2 The Recording Process PowerPoint Presentation, free

Drawings Debit or Credit? Financial

Web As The Debits And Credits Are Very Similar In What We Are Dealing With, We’ll Stick To Just Using A Company Structure In The Example.

Then At The End Of Each Year You Should Make A.

Web Owner’s Draws Are Withdrawals Of A Sole Proprietorship’s Cash Or Other Assets Made By The Owner For The Owner’s Personal Use.

Usually, Owners Have The Right To Do So Due To Their Ownership Of The.

Related Post: