Owner Draws In Quickbooks

Owner Draws In Quickbooks - It is necessary to make a record for the transactions of the owner’s withdrawal for the financial reasons of the company. Web what is the owner’s draw in quickbooks? It is also helpful to maintain current and prior year draw accounts for tax purposes. A clip from mastering quick. Select the date in the report period field. 40k views 4 months ago intermediate expense topics in. In the pay to the order of field, enter your name. The business owner takes funds out of the business for personal use. The benefit of the draw method is that it gives you more flexibility with your wages, allowing you to adjust your compensation based on the performance of your business. Owner equity (parent account) owner draws (sub account of owner equity) owner investment (sub account of owner equity) view solution. For those times when you need extra cash on hand, you. Web learn how to pay an owner of a sole proprietor business in quickbooks online. Enter the amount of the draw in the amount field. You may see one or more of these names: You can customize the report for the owner's draw you have set up in quickbooks. Enter owner draws as the account. Winter’s gone to bed and spring is in the air. Draw cash from a credit limit with quickbooks line of credit. Select the date in the report period field. So your chart of accounts could look like this. So your chart of accounts could look like this. Web recording the owner’s draw transaction in quickbooks involves accurately documenting the withdrawal amount and linking it to the designated equity account for comprehensive financial tracking. Enter owner draws as the account. It is also helpful to maintain current and prior year draw accounts for tax purposes. Web this tutorial will. An owner’s draw is when an owner takes money out of the business. Web how to complete an owner's draw in quickbooks online | qbo tutorial | home bookkeeper thanks for watching. Winter’s gone to bed and spring is in the air. It is also helpful to maintain current and prior year draw accounts for tax purposes. If your business is formed as a c corporation or an s corporation, you will most likely receive a paycheck just like you did when you were employed by someone else. Click chart of accounts and click add. 3. The benefit of the draw method is that it gives you more flexibility with your wages, allowing you to adjust your compensation based on the performance of your business. In the memo field, you can enter something like “owner’s draw for march.” 6. Web before deciding which method is best for you, you must first understand the basics. Open the chart of accounts and choose add. Web from understanding what owner’s draw is and how to record it in quickbooks to the essential steps for zeroing out owner’s draw, this article aims to provide a clear and actionable roadmap for business owners and accounting professionals alike. Web recording the owner’s draw transaction in quickbooks involves accurately documenting the withdrawal amount and linking it to the designated equity account for comprehensive financial tracking. Draws can happen at regular intervals or when needed. Web what is the owner’s draw in quickbooks? Know that you can select the equity account when creating a. Web when recording an owner's draw in quickbooks online, you'll need to create an equity account.

Quickbooks Owner Draws & Contributions YouTube

Owner's Draw Via Direct Deposit QuickBooks Online Tutorial The Home

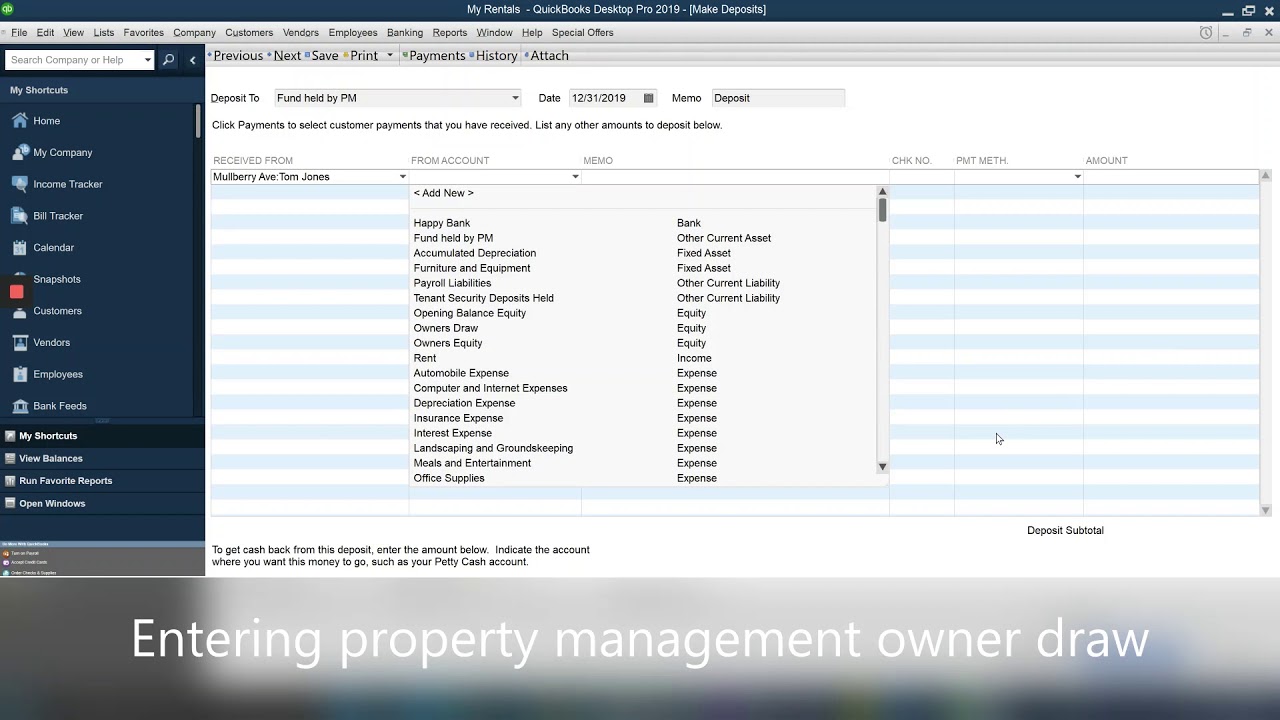

How to enter the property management owner draw to QuickBooks YouTube

This Can Be Achieved Through Various Methods Such As Creating A Journal Entry Or Using The Owner’s Equity Account.

If You're A Sole Proprietor, You Must Be Paid With An Owner's Draw Instead Of A Paycheck Through Payroll.

Enter The Amount Of The Draw In The Amount Field.

Owner’s Draw Refers To The Process Of Withdrawing Money From A Business For Personal Use By The Owner.

Related Post: