Maximum Earnings While Drawing Social Security

Maximum Earnings While Drawing Social Security - This amount is known as the “maximum taxable earnings” and changes each year. The special rule lets us pay a full social security check for any whole. Web how your earnings afect your social security benefits. At one of my first speaking engagements, i heard a great story from one of the attendees. If your goal is to collect the maximum $2,364 per month at age 62, you'll need to be reaching. During that period, the earnings limit that will apply to you nearly triples to $56,520. That applies until the date you hit fra: Web we use the following earnings limits to reduce your benefits: Web nearly 6 in 10 retirees say social security is a major source of income in retirement, according to an annual gallup poll. Web published october 10, 2018. For 2024 that limit is $22,320. 2023 social security income limit. You must promptly tell social security how much you expect to earn so that the correct amount can be withheld. If you’re not full retirement age in 2024, you’ll lose $1 in social security benefits for every $2 you earn above $22,320. We have a special rule for this. 2023 social security income limit. Web benefits planner | social security tax limits on your earnings | ssa. Web benefits planner | social security tax limits on your earnings | ssa. The amount you earn can impact the benefits you receive. For 2024 that limit is $22,320. The limit is $22,320 in 2024. Web in that case, the earnings limit is $59,520, with $1 in benefits withheld for every $3 earned over the limit. If you earn above the maximum taxable earnings for at least 35 years in your career, you'll be able to claim the maximum possible benefit. Web published october 10, 2018. Getting every penny. Web published october 10, 2018. Web this year, the limit is $142,800 per year, but in 2022, it will increase to $147,000 per year. Web during 2024, you plan to work and earn $24,920 ($2,600 above the $22,320 limit). Web how your earnings afect your social security benefits. Web we use the following earnings limits to reduce your benefits: If you’re not full retirement age in 2024, you’ll lose $1 in social security benefits for every $2 you earn above $22,320. If your goal is to collect the maximum $2,364 per month at age 62, you'll need to be reaching. You must earn $6,920 to get the maximum four credits for the year. Web in 2024, if you collect benefits before full retirement age and continue to work, the social security administration will temporarily withhold $1 in benefits for every $2 you earn over $22,320. Working while collecting social security. Maximum taxable earnings ( en español) if you are working, there is a limit on the amount of your earnings that is taxed by social security. If you exceed the limit, which is $21,240 in 2023, $1 of your benefits will be withheld for every $2 you make above the limit. During that period, the earnings limit that will apply to you nearly triples to $56,520. We would withhold $1,300 of your social security benefits ($1 for every $2 you earn over the limit). The special earnings limit rule is an exception to social security’s earnings limit — the cap on the amount you can make from work in. Maximum taxable earnings ( en español) if you are working, there is a limit on the amount of your earnings that is taxed by social security.

Limit For Maximum Social Security Tax 2022 Financial Samurai

Social Security Limit for 2022 Social Security Genius

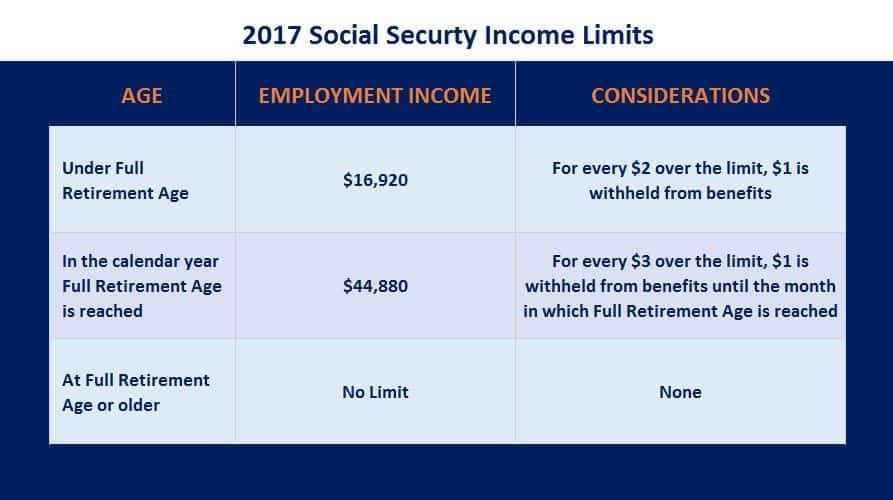

Social Security Limits 2017 Social Security Intelligence

Should Your Income Surpass This Threshold, Your Social Security Benefits Will Be Reduced.

Past That, There Is No Benefit Reduction, No Matter How Much You Earn.

This Amount Is Known As The “Maximum Taxable Earnings” And Changes Each Year.

Web There’s A Limit On How Much You Can Earn And Still Receive Your Full Social Security Retirement Benefits While Working.

Related Post: