Imf Special Drawing Right

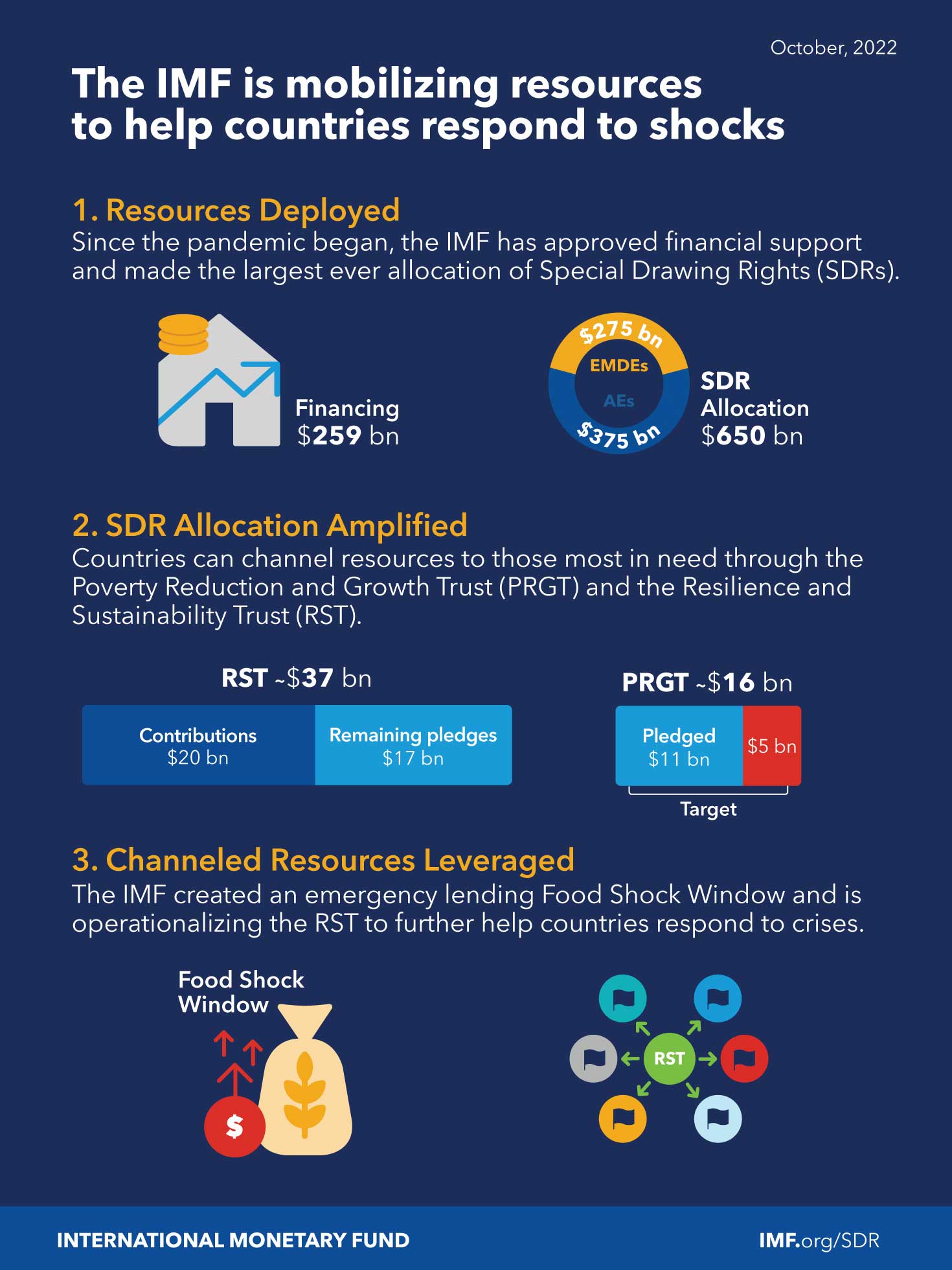

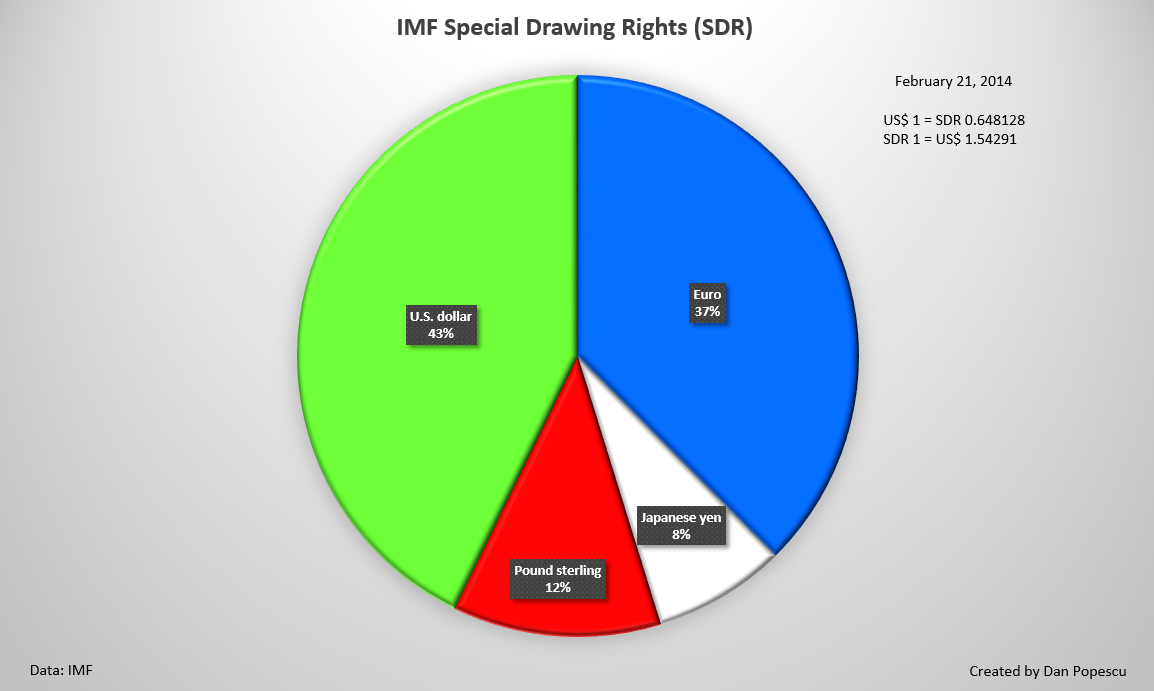

Imf Special Drawing Right - Web the international monetary fund (imf) allocates special drawing rights (sdr) to different countries. Special drawing rights (sdrs, code xdr) are supplementary foreign exchange reserve assets defined and maintained by the international monetary fund (imf). Web 1 usd = 0.760627 xdr. Web all operations and transactions involving sdrs are conducted through a special drawing rights department. •report climate change globalization and. This is for informational purposes only. Web special drawing rights: Sdrs were created in 1969 to supplement a shortfall of preferred foreign exchange reserve assets, namely gold and u.s. Web the imf’s $650 billion special drawing rights allocation is a historic decision that’s seen as ‘a shot in the arm for the global economy’ at a time of. You won’t receive this rate when sending money. They represent a claim to currency held by imf member countries for which they may be exchanged. Web 86 imf financial operations 2018 special drawing rights 4 their international reserves, together with their holdings of gold, foreign exchange, and reserve position in the imf. Web the special drawing right (sdr) was created in 1969 as an international reserve asset to. Web 86 imf financial operations 2018 special drawing rights 4 their international reserves, together with their holdings of gold, foreign exchange, and reserve position in the imf. You won’t receive this rate when sending money. Web the imf’s $650 billion special drawing rights allocation is a historic decision that’s seen as ‘a shot in the arm for the global economy’. 84k views 7 years ago. All other operations and transactions on account of the imf,. Sdrs are units of account for the imf, and not a currency per se. Web all operations and transactions involving sdrs are conducted through a special drawing rights department. Web imf special drawing rights: The right tool to use to respond to the pandemic and other challenges. The sdr is based on a. Web on monday, imf member countries start receiving their shares of the new $650bn special drawing rights allocation — the largest in the fund’s history. Web special drawing rights: Sdrs are units of account for the imf, and not a currency per se. 84k views 7 years ago. Explaining sdrs (special drawing rights) fora.tv. The special drawing right or. Web the special drawing right (sdr) was created in 1969 as an international reserve asset to supplement other reserve assets whose growth was seen as. Web 1 usd = 0.760627 xdr. Web recently, the international monetary fund (imf) has made an allocation of special drawing rights (sdr) 12.57 billion (equivalent to around $17.86 billion at the. Special drawing rights (sdr) the sdr is an international reserve asset, created by the imf in 1969 to supplement its member countries’ official reserves. Sdrs were created in 1969 to supplement a shortfall of preferred foreign exchange reserve assets, namely gold and u.s. You won’t receive this rate when sending money. Web 86 imf financial operations 2018 special drawing rights 4 their international reserves, together with their holdings of gold, foreign exchange, and reserve position in the imf. Special drawing rights (sdrs, code xdr) are supplementary foreign exchange reserve assets defined and maintained by the international monetary fund (imf).

Gold And The Special Drawing Rights (SDR) 1969Present

Special Drawing Rights (SDR) of IMF YouTube

Special Drawing Rights

Web The International Monetary Fund (Imf) Allocates Special Drawing Rights (Sdr) To Different Countries.

•Report Climate Change Globalization And.

Web All Operations And Transactions Involving Sdrs Are Conducted Through A Special Drawing Rights Department.

They Represent A Claim To Currency Held By Imf Member Countries For Which They May Be Exchanged.

Related Post: