How To Draw From 401K Early

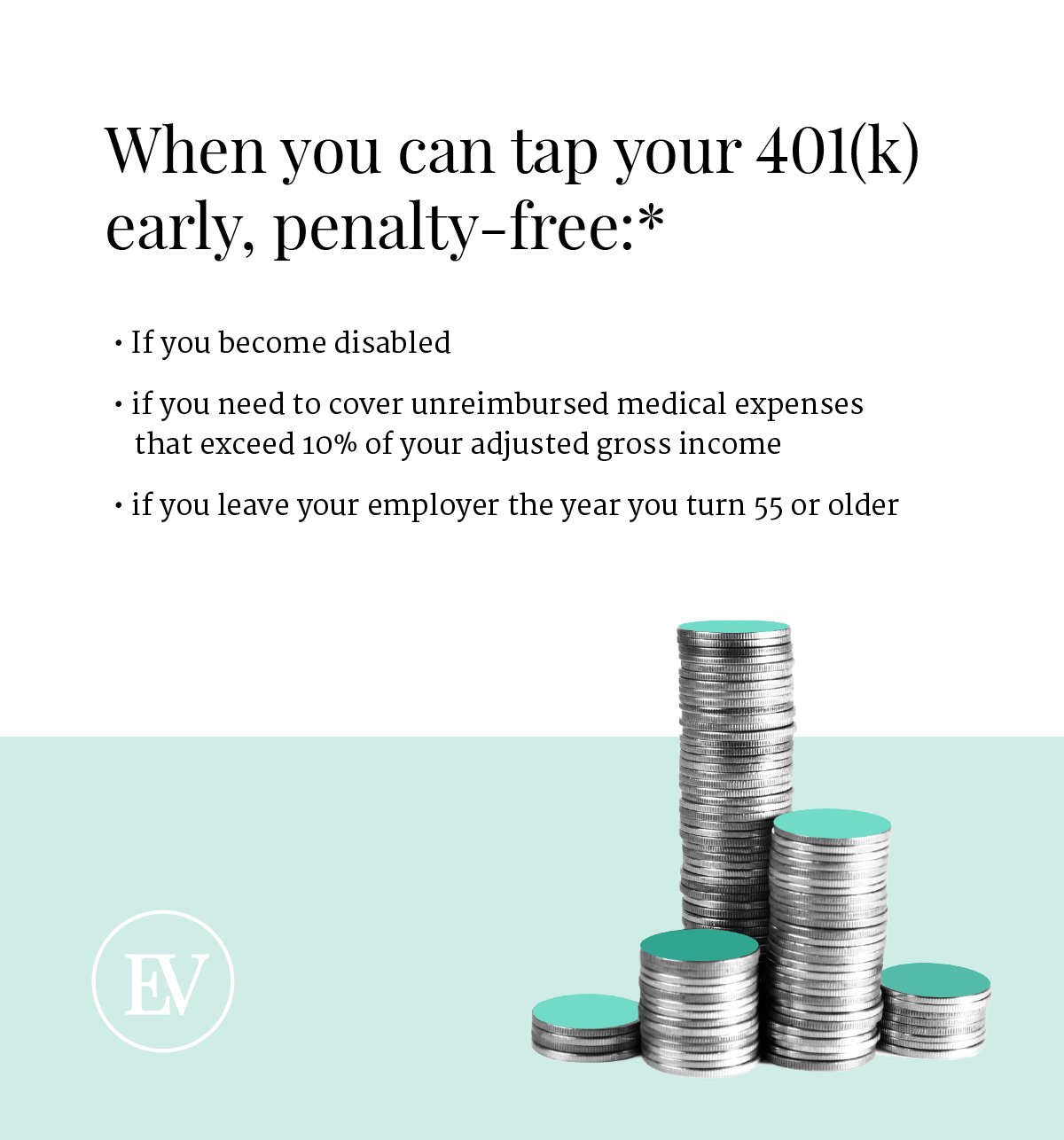

How To Draw From 401K Early - Find out how to calculate your 401(k) penalty if you plan to access funds early. Yes, it’s possible to make an early withdrawal from a 401 (k) plan at any time and for any reason. If you tap into it beforehand, you may face a 10% penalty tax on the withdrawal in addition to income tax that you’d owe on any type of withdrawal from a traditional 401 (k). Tero vesalainen / getty images. Learn your options for accessing funds in your 401 (k) or 403 (b) if you retire early. Web taking an early withdrawal from a 401(k) retirement account before age 59½ could have steep financial penalties. Web taking an early withdrawal from your 401(k) or ira has serious consequences. Web taking an early withdrawal from your 401 (k) should only be done as a last resort. An early withdrawal from a 401 (k) means missing out on the investment growth in the fund. The internal revenue service (irs) has set the standard retirement. Cashing out or taking a loan on your 401 (k) are two viable options if you're in need of funds. Get any financial question answered. Let's look at the pros and cons of different types of 401 (k) loans. The internal revenue service (irs) has set the standard retirement. In addition, your modified adjusted gross income must be less than. Yes, it’s possible to make an early withdrawal from a 401 (k) plan at any time and for any reason. Our calculator will show you the true cost of cashing out your 401(k) early. Early distributions may result in a 10% tax penalty. If you tap into it beforehand, you may face a 10% penalty tax on the withdrawal in. Written by javier simon, cepf®. Expected annual rate of return (%). A 401 (k) loan or an early withdrawal? A financial advisor can steer you through these decisions and help you manage your retirement savings. Early distributions may result in a 10% tax penalty. How much you expect your 401 (k) to grow on. Use this calculator to estimate how much in taxes you could owe if you take a distribution before retirement from your qualified employer sponsored retirement plan (qrp) such as a 401k, 403b or governmental 457b. Web can you withdraw money from a 401 (k) early? There are possible situations where you are allowed to withdraw from your account without incurring an early withdrawal penalty or the 10% early required minimum distribution tax penalty. They sport hefty contribution limits. Cashing out or taking a loan on your 401 (k) are two viable options if you're in need of funds. Yes, it’s possible to make an early withdrawal from a 401 (k) plan at any time and for any reason. Web how to use the rule of 55 to take early 401 (k) withdrawals. Edited by jeff white, cepf®. If you tap into it beforehand, you may face a 10% penalty tax on the withdrawal in addition to income tax that you’d owe on any type of withdrawal from a traditional 401 (k). Let's look at the pros and cons of different types of 401 (k) loans. Web a withdrawal permanently removes money from your retirement savings for your immediate use, but you'll have to pay extra taxes and possible penalties. Web here’s what you need to know if you’re considering taking an early withdrawal from your 401(k) and some alternatives that may prove to be better options for your financial situation. Web how to withdraw early from your 401 (k) written by true tamplin, bsc, cepf®. Updated on september 08, 2023. Tero vesalainen / getty images.

When Can I Draw From My 401k Men's Complete Life

401(k) or IRA How to Choose Where to Put Your Money Ellevest

When Can I Draw From My 401k Men's Complete Life

Web 401 (K) Or Other Qualified Employer Sponsored Retirement Plan (Qrp) Early Distribution Costs Calculator.

Web The 401 (K) Early Withdrawal Penalty Is Typically 10% Of The Amount Of Your Distribution, So You Can Calculate Your Tax Penalty By Multiplying The Amount You’re Planning To Withdraw By 0.1.

Tapping Your 401 (K) Early.

For 2024, You Can’t Put More Than $7,000 Into A Roth, Plus Another $1,000 If You’re Older Than 50.

Related Post: