How Much Can You Earn And Still Draw Social Security

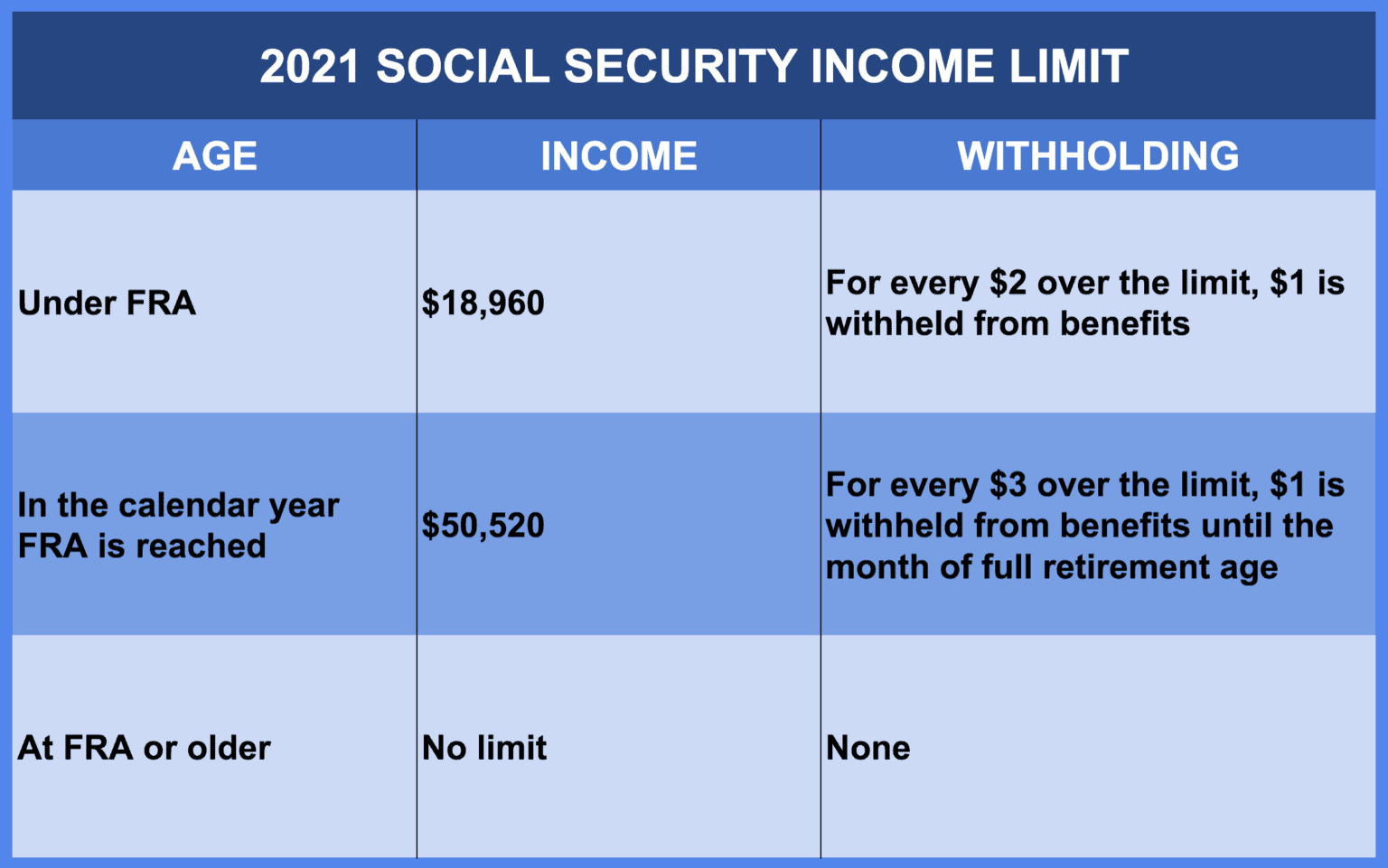

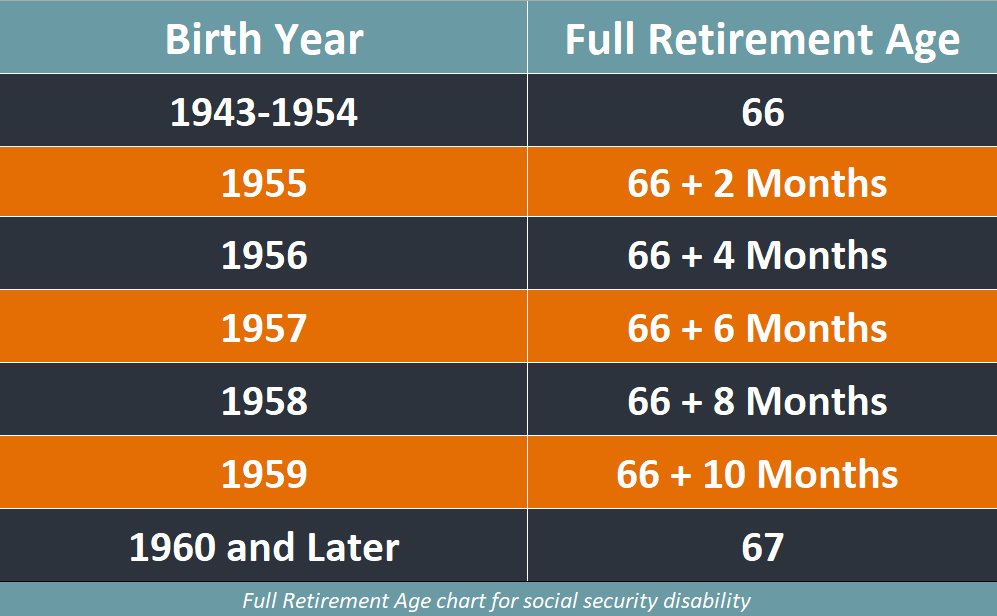

How Much Can You Earn And Still Draw Social Security - Web in 2024, you can earn up to $22,320 without having your social security benefits withheld. Web in that case, the earnings limit is $59,520, with $1 in benefits withheld for every $3 earned over the limit. Web for 2024, the earnings limit to collect social security before fra is $22,320. But beyond that point, you'll have $1 in benefits withheld per $2 of earnings. Web so benefit estimates made by the quick calculator are rough. Web the limit is $22,320 in 2024. Web this year, you can earn up to $19,560 without impacting your social security benefits. It is important to note that you cannot. Web under this rule, you can get a full social security benefit for any whole month you are retired and earnings are below the monthly limit. If this is the year you hit full retirement age, however, the rules are a little different. Web use this social security benefits calculator to estimate your retirement benefits based on your age, earnings and retirement date. Web using the ssa’s example in its “how work affects your benefits” publication, if your monthly social security payment at 62 years is $600 ($7,200/year) and you intend to. Starting with the month you reach full retirement age,. Web here’s. Web be under full retirement age for all of 2024, you are considered retired in any month that your earnings are $1,860 or less and you did not perform substantial services in self. Starting with the month you reach full retirement age, you can get your benefits with no limit on your earnings. Web if you delay your benefits from. Web use this social security benefits calculator to estimate your retirement benefits based on your age, earnings and retirement date. When you take benefits while you're still working, social security may withhold part of your benefit depending on. Calculating your social security retirement. If you will reach full. If this is the year you hit full retirement age, however, the. Web the threshold isn’t terribly high: Many people receiving social security retirement benefits choose to continue working or return to. Web how much can you earn while on social security: From there, you'll have $1 in social security withheld for every $2 you earn. It is important to note that you cannot. Web using the ssa’s example in its “how work affects your benefits” publication, if your monthly social security payment at 62 years is $600 ($7,200/year) and you intend to. Web to find out how much your benefit will be reduced if you begin receiving benefits from age 62 up to your full retirement age, use the chart below and select your year of birth. Web use this social security benefits calculator to estimate your retirement benefits based on your age, earnings and retirement date. Web so benefit estimates made by the quick calculator are rough. Past that, there is no benefit. Calculating your social security retirement. If this is the year you hit full retirement age, however, the rules are a little different. Web in that case, the earnings limit is $59,520, with $1 in benefits withheld for every $3 earned over the limit. Web you are entitled to $800 a month in benefits. If you retire at age 62 in 2024, the maximum amount is $2,710. Although the quick calculator makes an initial assumption about your past earnings, you will have the.

Social Security Limit 2021 Social Security Intelligence

Social Security Retirement Benefits Explained Sams/Hockaday & Associates

Can You Collect Social Security At 66 And Still Work Full Time?

Web Be Under Full Retirement Age For All Of 2024, You Are Considered Retired In Any Month That Your Earnings Are $1,860 Or Less And You Did Not Perform Substantial Services In Self.

There Is No Earnings Cap After Hitting Full Retirement Age.

($9,600 For The Year) You Work And Earn $32,320 ($10,000 More Than The $22,320 Limit) During The Year.

If You Will Reach Full.

Related Post: