Heloc Initial Draw

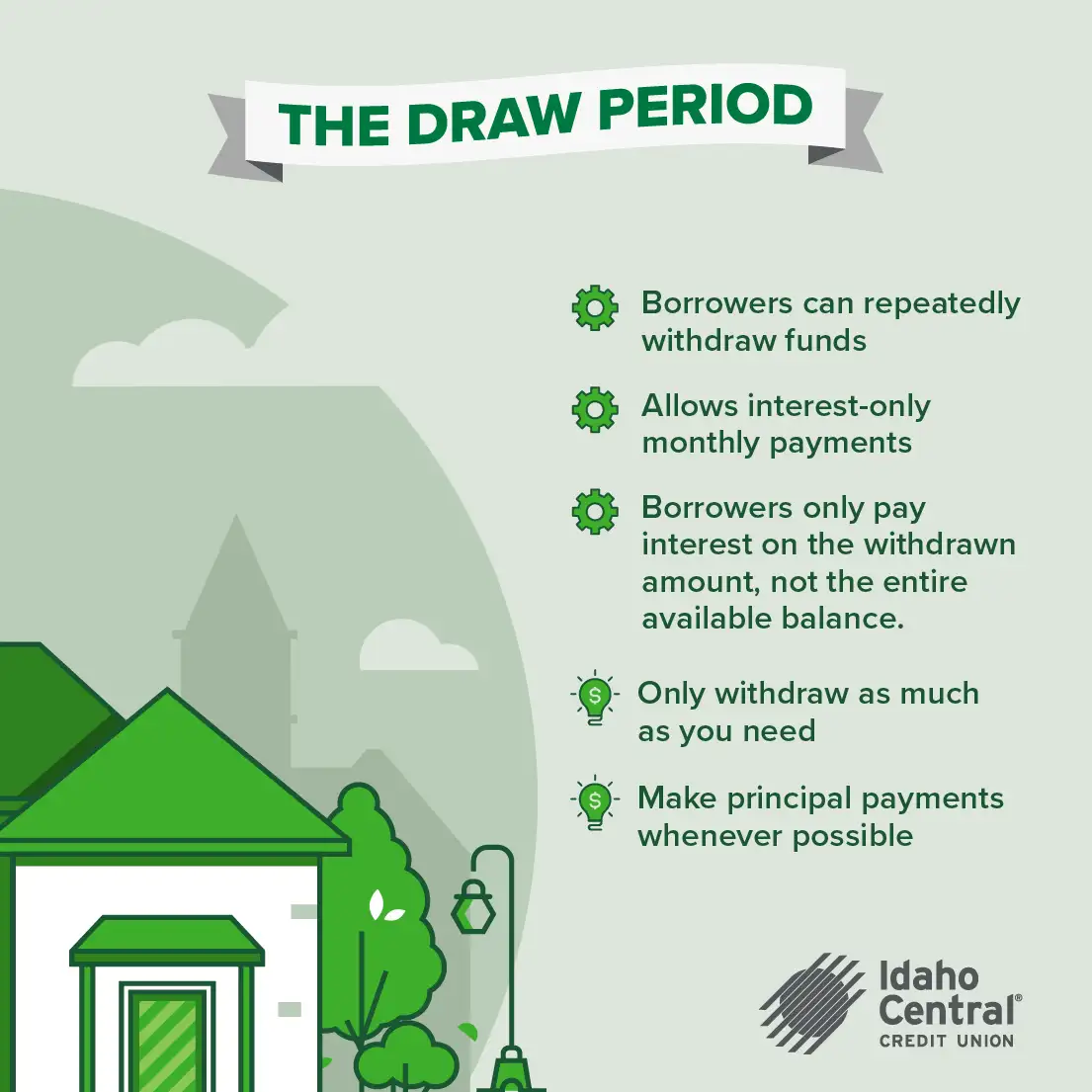

Heloc Initial Draw - Web a heloc means home equity line of credit and it's a revolving credit line that converts your home equity into funds you can withdraw at any time during your draw period. Web the interest rate on the initial amount is fixed at origination ¹, although it can change for additional draws that the borrower makes during a period of time known as. Web heloc draw periods last for years (ranging from five to 20 years, but usually 10 years), which gives you access to an open line of credit at a low interest rate for an. Web with a heloc, you’ll have access to a set sum of money that is structured as a revolving line of credit. Best helocs with low rates. Web the initial draw of helocs frequently lies in their introductory rates—enticing offers that promise reduced costs at the outset. A draw period is the amount of time you have to draw funds from a home equity line of credit (heloc). The draw period typically lasts up to. Discover how to make informed decisions about your home equity line of credit. Web learn what a heloc draw period is, how long it lasts, and how a heloc differs from a home equity loan so you can find the best way to use your home’s equity. In as few as 5 days. Web because a heloc is a line of credit and not a loan, you don't have to start using the money immediately; The draw period and the repayment period. Web the initial draw of helocs frequently lies in their introductory rates—enticing offers that promise reduced costs at the outset. Web the draw period is. You use only what you need and make monthly, interest. Web the interest rate on the initial amount is fixed at origination ¹, although it can change for additional draws that the borrower makes during a period of time known as. The draw period and the repayment period. You can borrow as needed up to an approved limit. Make an. You can borrow as needed up to an approved limit. Web understand the heloc draw period: Web because a heloc is a line of credit and not a loan, you don't have to start using the money immediately; The draw period typically lasts up to. Web with a heloc, you’ll have access to a set sum of money that is. You use only what you need and make monthly, interest. You can draw from it at any time during the draw period. Web a home equity line of credit (heloc) is divided into two distinct periods: Web the draw period is the initial phase of a home equity line of credit (heloc), during which you can withdraw funds, up to your credit limit. Web learn what a heloc draw period is, how long it lasts, and how a heloc differs from a home equity loan so you can find the best way to use your home’s equity. Unlike a credit card, however, a heloc includes two main phases: Learn how a draw period works so you can. Web the initial draw of helocs frequently lies in their introductory rates—enticing offers that promise reduced costs at the outset. Discover how to make informed decisions about your home equity line of credit. Web the interest rate on the initial amount is fixed at origination ¹, although it can change for additional draws that the borrower makes during a period of time known as. In as few as 5 days. The draw period typically lasts up to. Web because a heloc is a line of credit and not a loan, you don't have to start using the money immediately; Web for example, a borrower may obtain a $50,000 heloc but initially only draw down $10,000, which gives the borrower $40,000 in remaining borrowing capacity. The average heloc rate today ranges. Web the draw period is the initial phase of a home equity line of credit (heloc), during which you can withdraw funds, up to your credit limit.

HELOC Draw Period A Simple Guide for Borrowers

HELOC Requirements and How to Qualify Credello

HELOC Do’s and Don’ts A StepbyStep Guide to Home Equity Lines of

Why You Can Trust Forbes Advisor.

Web Heloc Draw Periods Last For Years (Ranging From Five To 20 Years, But Usually 10 Years), Which Gives You Access To An Open Line Of Credit At A Low Interest Rate For An.

The Draw Period And The Repayment Period.

Web With A Heloc, You’ll Have Access To A Set Sum Of Money That Is Structured As A Revolving Line Of Credit.

Related Post: