Drawing Social Security From Ex Spouse

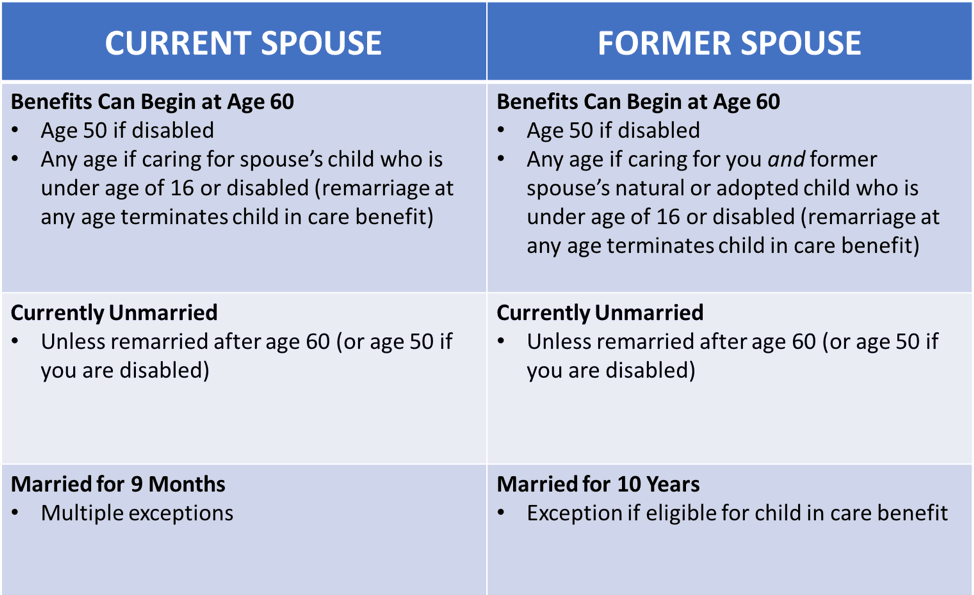

Drawing Social Security From Ex Spouse - Web unlike with married spouses, your ex spouse does not need to be drawing social security for you to draw a spousal benefit off him. If the number of months exceeds 36, then the benefit is further reduced 5/12. How the age you claim affects your monthly benefit. You will receive the higher of the two benefits. That includes divorced former spouses as well as the deceased's husband or wife at the time of death. Web the motley fool. You can apply online or. 62 years of age or older. Web published october 10, 2018. Web if you are age 62, unmarried, and divorced from someone entitled to social security retirement or disability benefits, you may be eligible to receive benefits based on his or her record. Second, her marriage to the ex must. Eligible children under 16 can also receive survivor benefits, worth up to 75% of the deceased's benefit. A spousal benefit is reduced 25/36 of one percent for each month before normal retirement age, up to 36 months. Online, if you are within 3 months of age 62 or older, or. Keep in mind. Web to qualify for spouse’s benefits, you must be one of the following: Web as of feb. 25, 2023, at 9:16 a.m. To be eligible, you must have been married to. That's not bad, but you might be able to do a lot better with a little. Web as of feb. If your spouse files for benefits at age 62, your spousal benefit will be permanently. Any age and have in your care a child younger than age 16, or who has a disability and is entitled to receive benefits on your spouse’s record. The average social security benefit is about $1,431 per month, or about $17,172. Web if you’re getting social security retirement benefits, some members of your family may also qualify to receive benefits on your record. Web to start, you must be at least 61 years and 9 months old and want your benefits to start in no more than four months, according to the social security administration (ssa). You will receive the higher of the two benefits. Web a spouse’s social security benefit is directly tied to the payout that the primary beneficiary receives. You are not yet full retirement age, you must apply for both benefits (known as deemed filing). Second, her marriage to the ex must. Web published october 10, 2018. Can someone get social security benefits on their former spouse’s record? And if they're remarried, their partner's earnings are safe. A representative at your local social security office can provide estimates of the benefit you can receive as a divorced spouse, based on your former wife’s or husband’s earnings record. If you are divorced and your marriage lasted at least 10 years, you may be able to get benefits on your former spouse’s record and your former spouse may be able to get benefits on your record. / updated january 19, 2024. If you turn 62 on or after january 2, 2016, and: How the age you claim affects your monthly benefit. Web published may 10, 2021. You are eligible to collect spousal benefits on a living former wife’s or husband’s earnings record as long as:

How Many Spouses Can Draw Social Security From ONE ExHusband? YouTube

What’s The Right Age To Start Drawing Social Security? To Our

3 Most Important Things to Know About the Social Security Surviving

Eligible Children Under 16 Can Also Receive Survivor Benefits, Worth Up To 75% Of The Deceased's Benefit.

You Are At Least 62 Years Of Age.

Anyone Who Was Married To A Social Security Beneficiary Can Potentially Receive Survivor Benefits On The Death Of That Person.

The Provision Applies To Divorced As Well As Married Filers.

Related Post: