Drawing From 401K For Home Purchase

Drawing From 401K For Home Purchase - Web withdrawing 401 (k) funds to buy a home. First, 401 (k) withdrawals are subject to income taxes. Web generally, home buyers who want to use their 401 (k) funds to finance a real estate transaction can borrow or withdraw up to 50% of their vested balance or a maximum of $50,000 — whichever is less. There are many alternatives to using your 401 (k) to purchase a home. Web there are two ways to tap your 401(k) to buy a house. Not all plans permit loans, so check with your employer before pursuing this option. Except in extreme cases, buying a house with 401 (k) retirement money should be a last resort. Regardless, you will still likely incur the 10% early withdrawal penalty. This limit typically applies to any 401 (k) loan, not only a home purchase. Thinking of taking money out of a 401 (k)? You should consider a few essential details before making a 401 (k) withdrawal to cover a down payment or closing costs. The standard 401 (k) withdrawal period begins once a plan participant turns 65, or earlier if the plan allows. Web there are two ways to tap your 401(k) to buy a house. You can either take a 401(k) loan. Buy a house with a 401 (k) retirement plan. You should consider a few essential details before making a 401 (k) withdrawal to cover a down payment or closing costs. Continue reading to learn how to use your 401 (k) to buy a house. Withdrawing from your retirement account early may incur a 10% early withdrawal penalty, and you’ll be. Mcdowell | updated november 18, 2018. If you decide to do so, you have two options: 4 potential drawbacks of using your 401 (k) to buy a house. Web while drawing on your 401 (k) to buy a home is possible, you can’t use it as a first resort or withdraw more than you need. The standard 401 (k) withdrawal. Web may 11, 2023, at 2:15 p.m. Web whether or not the purchase of a home using your 401 (k) counts as a hardship withdrawal is a determination that falls to your employer, and you’ll need to present evidence of hardship before the withdrawal can be approved. You may be able to withdraw from your 401 (k) to purchase a home. Web to borrow from your 401k loan to finance a down payment, you’ll need to talk to your employer’s benefits office or hr department, or with your 401k plan provider. If you have a 401 (k) retirement account,. If you need cash for a down payment for a home, and you have a 401 (k) retirement plan, you might be wondering if you can use these. 4 potential drawbacks of using your 401 (k) to buy a house. For example, if you received a gift from family to purchase your home, or have savings or investment accounts, you must use those sources before taking a hardship distribution. The rules around early withdrawals will be outlined in your 401 (k) plan. 401 (k) accounts are designed to provide you with an income in retirement, and there are rules to encourage you to leave the money in the. Web generally, home buyers who want to use their 401 (k) funds to finance a real estate transaction can borrow or withdraw up to 50% of their vested balance or a maximum of $50,000 — whichever is less. You can either take a 401(k) loan or withdraw the funds from your account. Web updated march 23, 2023. Web fact checked by marcus reeves. Early 401 (k) withdrawals come with penalty fees and taxes if you’re younger than age 59 1/2. Gili benita for the new york times.

Should You Borrow From Your 401k to Purchase a Home?

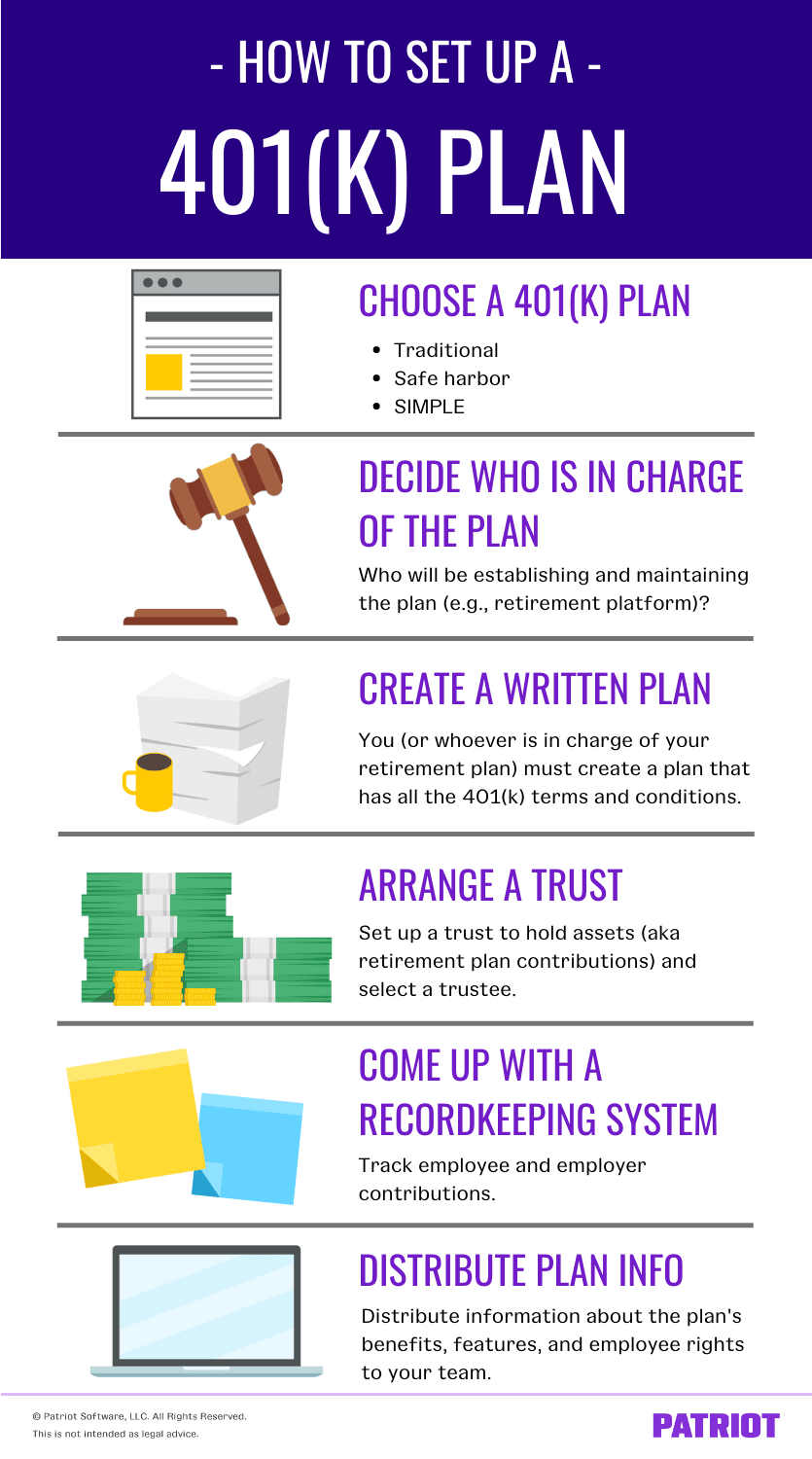

How to Set up a 401(k) Plan for Small Business Steps & More

When Can I Draw From My 401k Men's Complete Life

Web Withdrawing 401 (K) Funds To Buy A Home.

There Are Many Alternatives To Using Your 401 (K) To Purchase A Home.

Additionally, You’ll Pay An Additional 10% Penalty Tax On Any Withdrawal Made Before Age 59 ½ That Doesn’t Meet Certain Exceptions.

Web And For Some People, Saving For Retirement Solely In A 401 (K) Could Make Sense.

Related Post: