Define Special Drawing Rights

Define Special Drawing Rights - Web special drawing right, established and created by the imf in 1969, is a supplement reserve of foreign exchange assets comprising leading currencies across the globe for settling international transactions. Special drawing rights (sdrs) were created in 1969 as an international reserve asset to supplement other reserve assets whose growth was inadequate to finance the expansion of international trade and finances under the bretton woods system in the postwar period and to support the bretton woods fixed exchange. To deal with the inability of the existing system to create an adequate quantity of reserves without requiring the united states to run large deficits, a new kind of reserve called special drawing rights (sdrs) was devised by the international monetary fund. How many sdrs have been allocated so far? Learn more q&a on sdrs. Dollar, japanese yen, euro, pound sterling and chinese renminbi. The sdr's intended purpose, though, was more modest: The sdr is based on a basket of international currencies comprising the u.s. Web the bottom line. They represent a claim to currency held by imf member countries for which they may be exchanged. What is the value of an sdr? Web the special drawing right or sdr is an international reserve asset created by the imf to supplement the official reserves of its member countries and can be. Special drawing rights (sdr) english. Members in sdrs, and (4) payment of the reserve asset portion. A currency created by the international monetary fund, used. What are the purpose and benefits of the 2021 general sdr allocation? The sdr is not a currency, but its value is based on a basket of five currencies—the us dollar, the euro, the chinese renminbi, the japanese yen, and the british pound sterling. Web special drawing right, established and created by the imf in 1969, is a supplement reserve. Members in sdrs, and (4) payment of the reserve asset portion. They represent a claim to currency held by imf member countries for which they may be exchanged. Web special drawing rights (sdrs) are supplementary foreign exchange reserve assets defined and maintained by the international monetary fund (imf). A currency created by the international monetary fund, used for payments between. Sdrs are units of account for the imf, and not a currency per se. Special drawing rights are a world reserve asset whose value is based on a basket of four major international currencies. How much of a general allocation is distributed to each member country? Web the bottom line. How did the fourth amendment special allocation of sdrs come about? Web special drawing rights (sdr) are the monetary unit of the reserve assets of the international monetary fund (imf). To deal with the inability of the existing system to create an adequate quantity of reserves without requiring the united states to run large deficits, a new kind of reserve called special drawing rights (sdrs) was devised by the international monetary fund. This is a kind of reserve of foreign exchange assets comprising leading currencies globally and created by the international monetary fund in the year 1969. Special drawing rights (sdr) english. Special drawing rights (sdrs) were created in 1969 as an international reserve asset to supplement other reserve assets whose growth was inadequate to finance the expansion of international trade and finances under the bretton woods system in the postwar period and to support the bretton woods fixed exchange. Web inflows of sdrs into the general resources account include. The sdr is also used by some countries as a peg for their own currency, and is used as an international reserve asset. The sdr is not a currency, but its value is based on a basket of five currencies—the us dollar, the euro, the chinese renminbi, the japanese yen, and the british pound sterling. Web the sdr (special drawing right) is an artificial basket currency used by the imf (international monetary fund) for internal accounting purposes. Following the rio agreement in 1967, the birth of the special drawing right (sdr) was widely heralded as the first step towards a world international money. Web special drawing right, established and created by the imf in 1969, is a supplement reserve of foreign exchange assets comprising leading currencies across the globe for settling international transactions.

Special Drawing Rights Meaning Of Special Drawing Rights Paper Gold

PPT International business environment PowerPoint Presentation, free

Special Drawing Rights

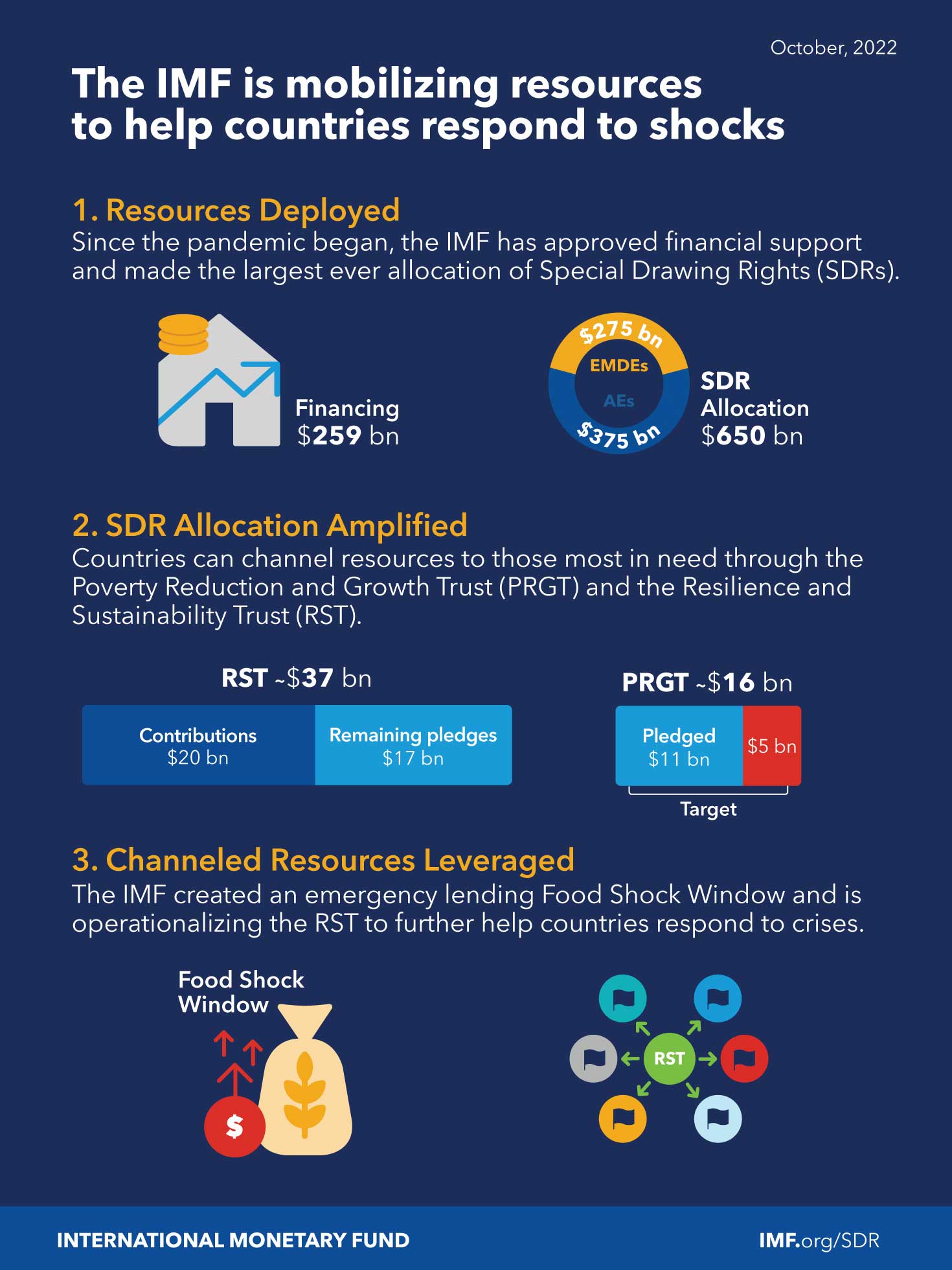

How Many Sdrs Have Been Allocated So Far?

Web Special Drawing Rights (Sdrs, Code Xdr) Are Supplementary Foreign Exchange Reserve Assets Defined And Maintained By The International Monetary Fund (Imf).

Sdrs Are Used By The Imf To Make Emergency Loans And Are.

Sdrs Are Units Of Account For The Imf, And Not A Currency Per Se.

Related Post: