At What Age Do You Have To Draw From 401K

At What Age Do You Have To Draw From 401K - Reach age 72 (73 if you reach age 72 after dec. Web you can begin to withdraw from your 401 (k) without penalty when you reach age 55 through age 59½. Web one exception to the 401 (k) early withdrawal penalty is known as the rule of 55, and it can allow you to take distributions from your 401 (k) or 403 (b) without having to pay a penalty. In certain circumstances, the plan administrator must obtain your consent before making a distribution. You can't take loans from old 401(k) accounts. Depending on the terms of the plan, distributions may be: Participants in a traditional 401 (k) plan are not allowed to withdraw their funds until they reach age 59½, with the exception of withdrawing funds to cover some hardships or life. Web however, the internal revenue service (irs) requires that you start taking withdrawals from their qualified retirement accounts when you reach the age 72. Web with a roth 401(k), you don’t have to worry about paying taxes when it’s time to withdraw funds from the account. Except in special cases, you can’t take a distribution from your plan at all until you’ve reached age 59.5. Account owners can delay taking their first rmd until april 1 following the later of the calendar year they reach age 72 or, in a workplace retirement plan, retire. Your plan administrator will let you know whether they allow an exception to the required minimum distribution rules if you're still working at age 72. Reach age 72 (73 if you. Web however, the internal revenue service (irs) requires that you start taking withdrawals from their qualified retirement accounts when you reach the age 72. Web it's important to consider how 401 (k) withdrawals, which are required after age 73 (or, if you turn 74 after december 31, 2032, it's age 75), may affect your tax bill once they're added to.. You can't take loans from old 401(k) accounts. Reach age 72 (73 if you reach age 72 after dec. Your age determines what actions you may take in your retirement plan. Web first, let’s recap: Web you can begin to withdraw from your 401 (k) without penalty when you reach age 55 through age 59½. 1 if you will turn 72 after jan. You can't take loans from old 401(k) accounts. Periodic, such as annuity or installment payments. Web it's important to consider how 401 (k) withdrawals, which are required after age 73 (or, if you turn 74 after december 31, 2032, it's age 75), may affect your tax bill once they're added to. For example, you won’t be able to withdraw your roth 401(k) contributions until age 59½ or you experience another qualifying event such as disability, termination of employment, financial hardship, or death. Your age determines what actions you may take in your retirement plan. Your plan administrator will let you know whether they allow an exception to the required minimum distribution rules if you're still working at age 72. Web one exception to the 401 (k) early withdrawal penalty is known as the rule of 55, and it can allow you to take distributions from your 401 (k) or 403 (b) without having to pay a penalty. Web it expects to report to congress with recommendations by the end of 2025, ms. Retire (if your plan allows this). Web there is no way to take a distribution from a 401 (k) without owing income taxes at the rate you’re paying the year you take the distribution. Web you reach age 59½ or experience a financial hardship. Web the median 401 (k) balance for americans ages 40 to 49 is $38,600 as of the fourth quarter of 2023, according to data from fidelity investments, the nation’s largest 401 (k) provider. Web generally, if you are age 73, you've reached the age where the irs mandates you start taking withdrawals from most qualified retirement accounts, such as iras and 401(k)s (but not roth iras). 1, 2023, you do not have to start taking rmds until age 73. Participants in a traditional 401 (k) plan are not allowed to withdraw their funds until they reach age 59½, with the exception of withdrawing funds to cover some hardships or life.:max_bytes(150000):strip_icc()/how-to-take-money-out-of-a-401k-plan-2388270-v6-5b575ead4cedfd0036bbfb6f.png)

Can I Borrow Against My 401k To Start A Business businesser

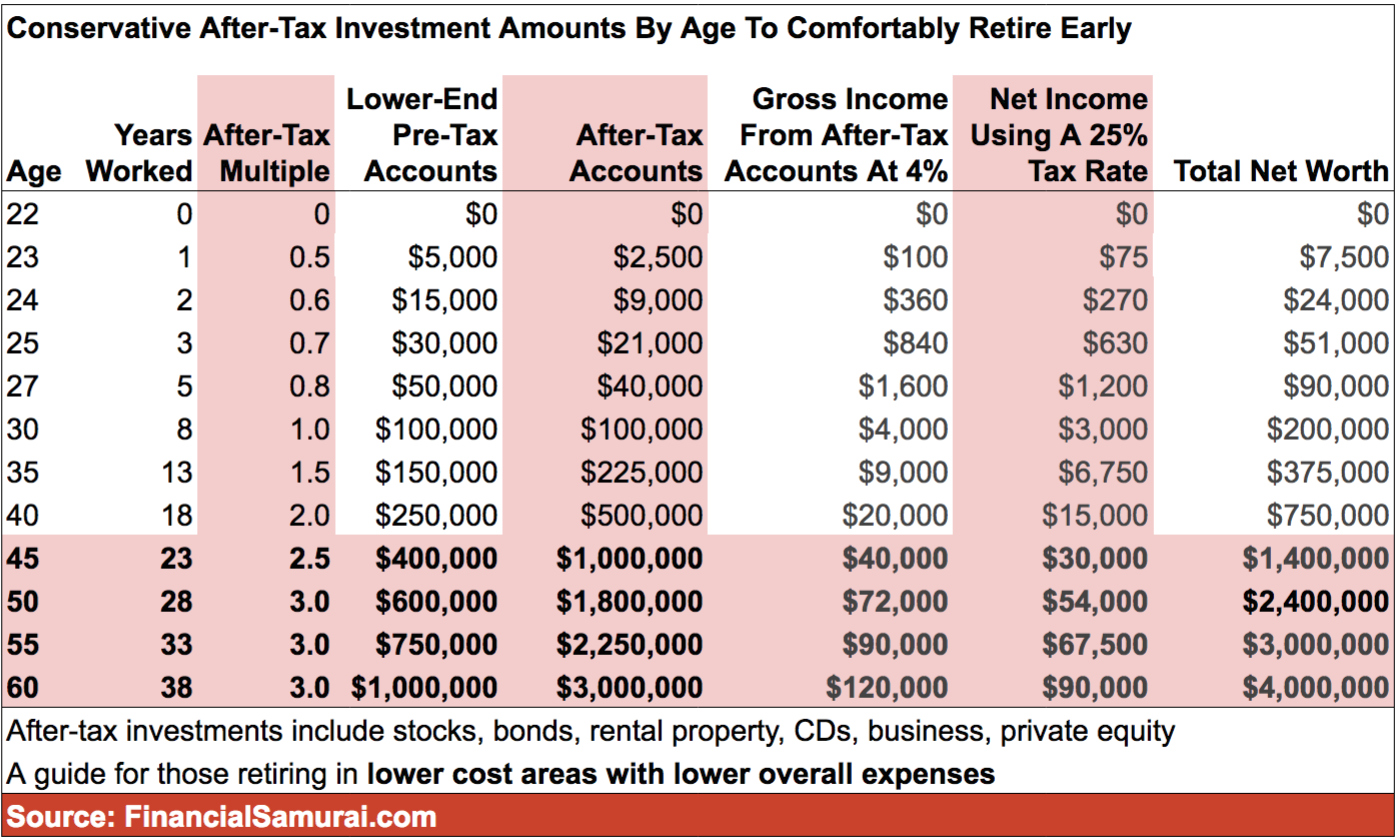

How Much Should I Have in My 401k During My 20's, 30's, 40's and 50's

401k By Age Are You Saving Enough For Retirement?

Web You Generally Must Start Taking Withdrawals From Your 401 (K) By Age 73 But Can Avoid This Requirement If You’re Still Working.

This Calculator Has Been Updated For The 'Secure Act Of 2019 And Cares.

How Old Will You Be At The End Of This Year?

These Withdrawals Are Called Required Minimum Distributions (Rmds).

Related Post: