At What Age Can You Start Drawing From Your 401K

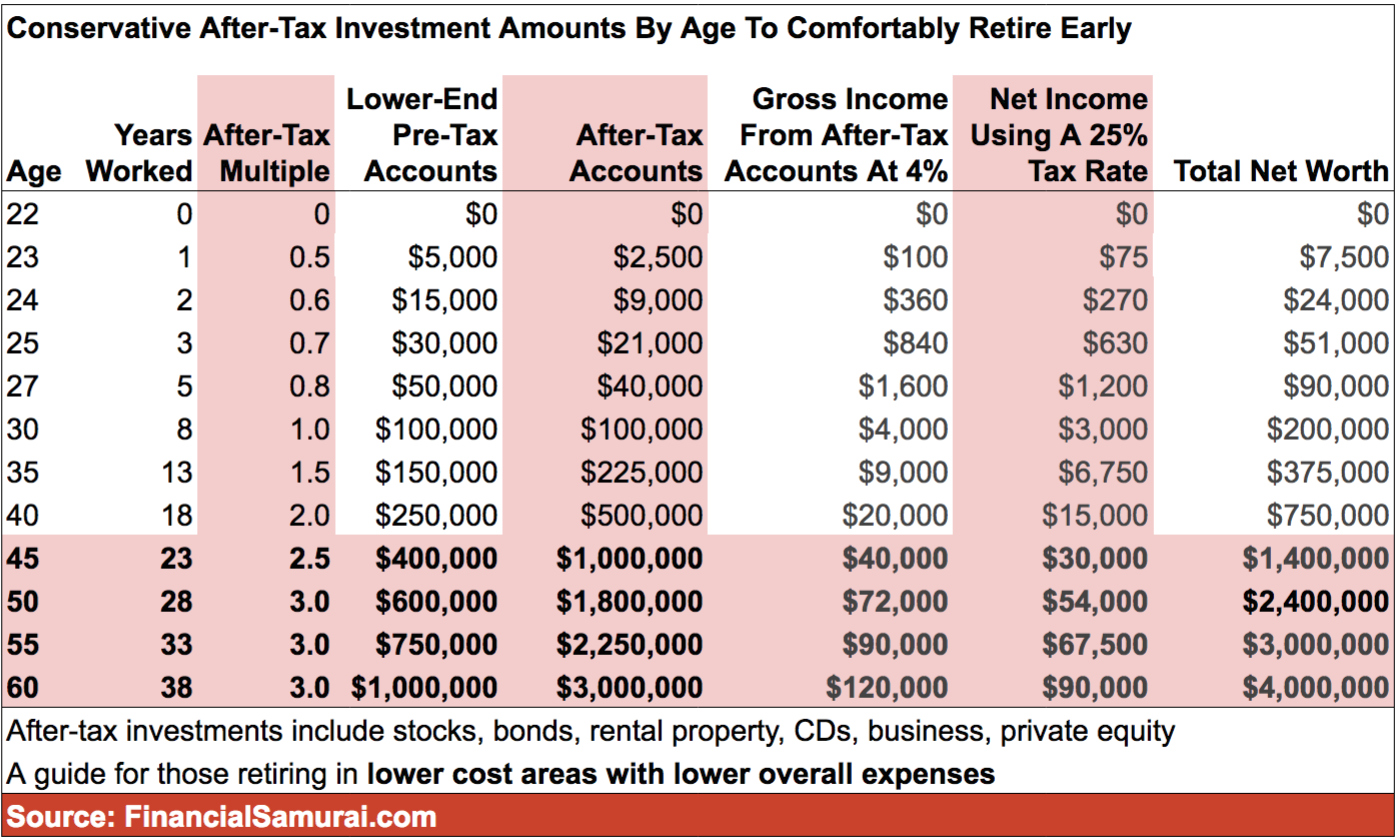

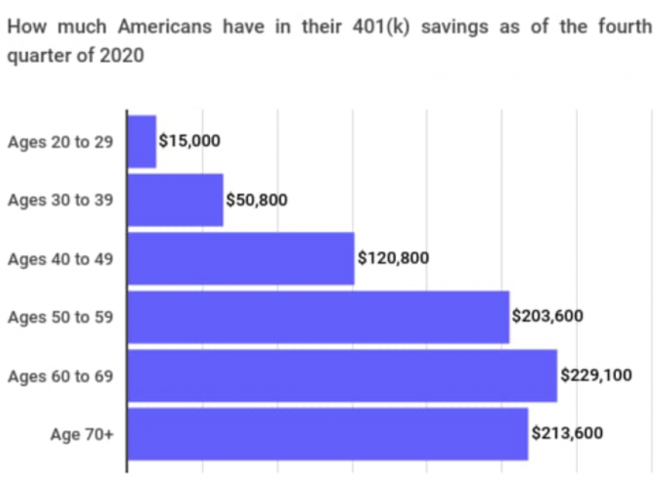

At What Age Can You Start Drawing From Your 401K - You’re not age 55 yet. It depends on your age. Web as a general rule, if you withdraw funds before age 59 ½, you’ll trigger an irs tax penalty of 10%. The good news is that there’s a way to take your distributions a few years early without incurring this penalty. You can't take loans from old 401(k) accounts. Updated on october 25, 2021. Note that the secure 2.0 act raised the age. And you’ll have to pay taxes on the rmd amounts in the year they are taken. Web one exception to the 401 (k) early withdrawal penalty is known as the rule of 55, and it can allow you to take distributions from your 401 (k) or 403 (b) without having to pay a penalty. When can a retirement plan distribute benefits? The good news is that there’s a way to take your distributions a few years early without incurring this penalty. Some reasons for taking an early 401. And hundreds of thousands, if not millions, of us actually have accounts. Turn 65 (or the plan’s normal retirement age, if earlier); Web edited by jeff white, cepf®. And hundreds of thousands, if not millions, of us actually have accounts. Some reasons for taking an early 401. Complete 10 years of plan participation; Web as a general rule, if you withdraw funds before age 59 ½, you’ll trigger an irs tax penalty of 10%. Web you generally must start taking withdrawals from your 401 (k) by age 73. Web once you reach age 72, you have to start taking required minimum distributions (rmds). Web in that scenario, let’s say your salary is $100,000 and your employer matches 50% of the first 6% you contribute to your 401(k). If you contribute up to the matching amount, you get the full. Web it expects to report to congress with recommendations. A 5% owner of the employer must begin taking rmds at age 72. By kate stalter and emily brandon. Web the median 401 (k) balance for americans ages 40 to 49 is $38,600 as of the fourth quarter of 2023, according to data from fidelity investments, the nation’s largest 401 (k) provider. Anyone eligible can contribute to an employer's 401 (k), but income limits apply to roth iras. You can start withdrawing 4% of the money in your 401 (k) or iras annually. Web once you reach age 72, you have to start taking required minimum distributions (rmds). You can't start taking distributions from your 401 (k) and avoid the early withdrawal penalty once you reach 55. You can't take loans from old 401(k) accounts. Complete 10 years of plan participation; Since both accounts have annual contribution limits and potentially different tax benefits. Make adjustments to that percentage depending on your circumstances. Web you can make a 401 (k) withdrawal at any age, but doing so before age 59 ½ could trigger a 10% early distribution tax, on top of ordinary income taxes. If you tap into it beforehand, you may face a 10% penalty tax on the withdrawal in addition to income tax that you’d owe on any type of withdrawal from a traditional 401 (k). You can contribute to a roth ira (a type of individual retirement plan) and a 401 (k) (a workplace retirement plan) at the same time. Web the rule of 55 doesn't apply if you left your job at, say, age 53. Turn 65 (or the plan’s normal retirement age, if earlier);

Important ages for retirement savings, benefits and withdrawals 401k

401k By Age Are You Saving Enough For Retirement?

401k Savings By Age How Much Should You Save For Retirement

Taking That Route Is Not Always Advisable, Though, As Early Withdrawals Deplete Retirement Savings.

The Good News Is That There’s A Way To Take Your Distributions A Few Years Early Without Incurring This Penalty.

Terminate Service With The Employer.

Web Required Minimum Distributions (Rmds) Are The Minimum Amounts You Must Withdraw From Your Retirement Accounts Each Year.

Related Post: