At What Age Can I Draw From My 401K

At What Age Can I Draw From My 401K - Web it depends on your age. Affordable policiesprotect your familyknowledgeable agents Web it expects to report to congress with recommendations by the end of 2025, ms. Web for 2023, the age at which account owners must start taking required minimum distributions goes up from age 72 to age 73, so individuals born in 1951 must receive their first. Web also, a 10% early withdrawal penalty applies on withdrawals before age 59½, unless you meet one of the irs exceptions. Web you can make a 401 (k) withdrawal at any age, but doing so before age 59 ½ could trigger a 10% early distribution tax, on top of ordinary income taxes. Sign up for fidelity viewpoints weekly email for our. Once you reach age 59.5, you may withdraw money from your 401 (k). Depending on the terms of the plan, distributions may be: Edited by jeff white, cepf®. Find out when you must start taking rmds, how to calculate them,. Web learn when you can withdraw funds from your 401 (k) plan without paying a 10% penalty tax. Be at least age 55 or older. A 401 (k) early withdrawal is any money you take out from your retirement account before you’ve reached federal retirement age, which is. Web if you first turn 72 on or after january 1, 2023, the required beginning date for rmds is april 1 of the year after you turn age 73. Scroll the section below that correlates with your age, and you’ll find the rules applicable to you. Web you generally must start taking withdrawals from your 401 (k) by age 73. Web it expects to report to congress with recommendations by the end of 2025, ms. If that happens, you might need to begin taking distributions from your 401 (k). Edited by jeff white, cepf®. Sign up for fidelity viewpoints weekly email for our. Have left your employer voluntarily or involuntarily in. Scroll the section below that correlates with your age, and you’ll find the rules applicable to you. Web for 2023, the age at which account owners must start taking required minimum distributions goes up from age 72 to age 73, so individuals born in 1951 must receive their first. Advice & guidanceaccess to advisors Master the fundamentals.learn more.learn finance easily.find out today. Web it expects to report to congress with recommendations by the end of 2025, ms. Web to qualify for the rule of 55, withdrawals must be made in the year that an employee turns 55 (or older) and leaves their employer, either to retire early or for any other reason. Web learn when you can withdraw funds from your 401 (k) plan without paying a 10% penalty tax. You’re not age 55 yet. Be at least age 55 or older. Web to use the rule of 55, you’ll need to: Early withdrawals occur if you receive money from a 401 (k) before age 59 1/2. Web as a general rule, if you withdraw funds before age 59 ½, you’ll trigger an irs tax penalty of 10%. Find out when you must start taking rmds, how to calculate them,. In most, but not all, circumstances, this triggers an early. Edited by jeff white, cepf®. Web you can make a 401 (k) withdrawal at any age, but doing so before age 59 ½ could trigger a 10% early distribution tax, on top of ordinary income taxes.

401k By Age PreTax Savings Goals For Retirement Financial Samurai

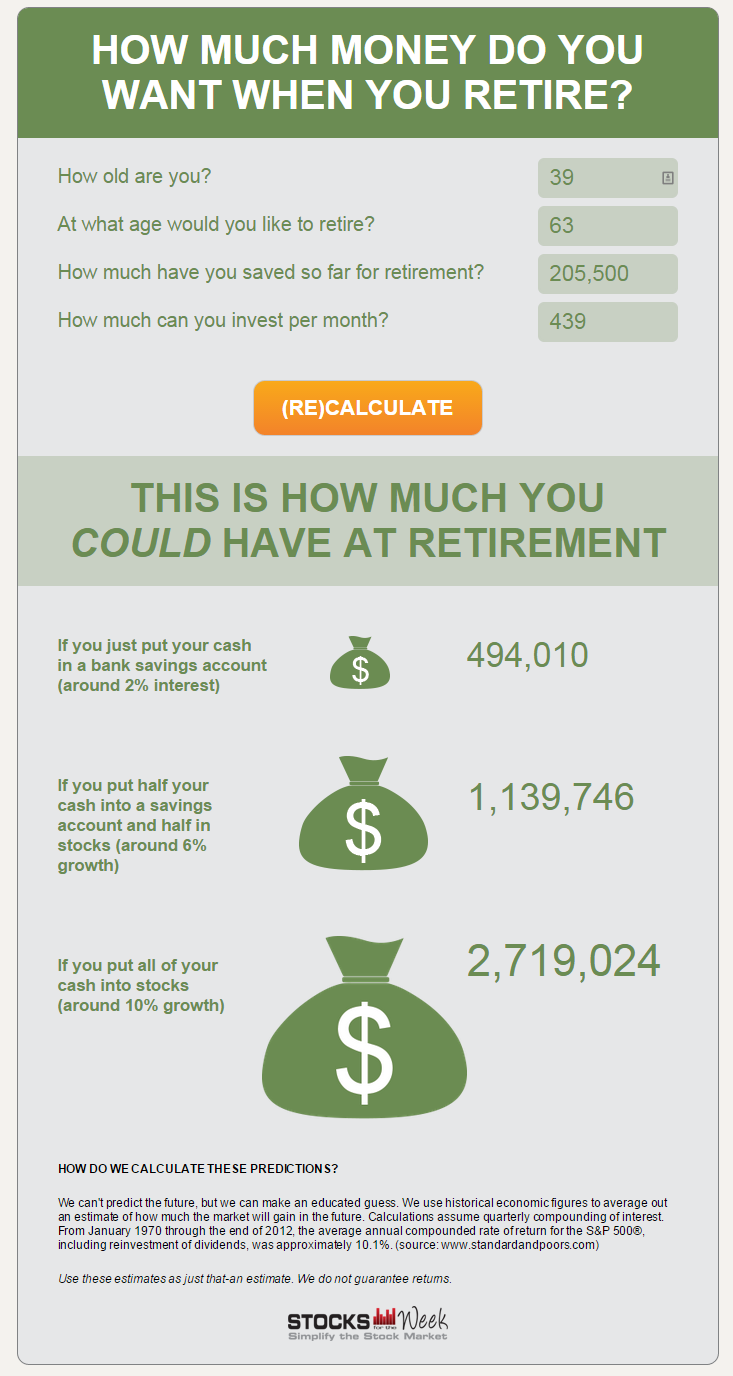

How to Estimate How Much Your 401k will be Worth at Retirement

Why The Median 401(k) Retirement Balance By Age Is So Low

Different Rules For Commencing Rmds May Apply If.

Web The Terms Of Roth 401 (K) Accounts Also Stipulate That Required Minimum Distributions (Rmds) Must Begin By Age 73, Or Age 70½ If You Reached That Age By Jan.

The Maximum Contribution For Employees And.

Web The Irs Rule Of 55 Recognizes You Might Leave Or Lose Your Job Before You Reach Age 59½.

Related Post: