At What Age Can I Draw From 401K

At What Age Can I Draw From 401K - Web when can a retirement plan distribute benefits? This is known as the rule of 55. You’re not age 55 yet. Web if your employer allows it, it’s possible to get money out of a 401 (k) plan before age 59½. A 401 (k) early withdrawal is any money you take out from your retirement account before you’ve reached federal retirement age, which is currently 59 ½. With a roth 401 (k) (not offered by all employer plans), your money also. Web required minimum distributions, or rmds, are minimum amounts that many retirement plan and ira account owners must generally withdraw annually after they reach age 72. Periodic, such as annuity or installment payments. (these are called required minimum distributions, or rmds). Depending on the terms of the plan, distributions may be: There are some exceptions to these rules for 401 (k) plans and other qualified plans. Web when can a retirement plan distribute benefits? Web also, a 10% early withdrawal penalty applies on withdrawals before age 59½, unless you meet one of the irs exceptions. Taking that route is not always advisable, though, as early withdrawals deplete retirement savings. Web age. Web understanding early withdrawals. If you tap into it beforehand, you may face a 10% penalty tax on the withdrawal in addition to income tax that you’d owe on any type of withdrawal from a traditional 401 (k). 16, 2022, at 11:22 a.m. Web it expects to report to congress with recommendations by the end of 2025, ms. Web you. The good news is that there’s a way to take your distributions a few years early without incurring this penalty. Depending on the terms of the plan, distributions may be: The best idea for 401(k) accounts from a previous employer is to roll them over when you leave a job. Some reasons for taking an early 401. You can make. Have left your employer voluntarily or involuntarily in the year you turn 55 or later. Web you can generally take 401(k) withdrawals before age 59½ if you become disabled, you have a severance from employment, your 401(k) plan is terminated or you experience financial hardship. Web as a general rule, if you withdraw funds before age 59 ½, you’ll trigger an irs tax penalty of 10%. Note that the secure 2.0 act raised the age. You can access funds from an old 401(k) plan after you reach age 59½ even if you haven't yet retired. You generally must start taking withdrawals from your traditional ira, sep ira, simple ira, and retirement plan accounts when you reach age 72 (73 if you reach age 72 after dec. Turn 65 (or the plan’s normal retirement age, if earlier); In certain circumstances, the plan administrator must obtain your consent before making a distribution. And you’ll have to pay taxes on the rmd amounts in the year they are taken. (these are called required minimum distributions, or rmds). A reliable stream of funds to live on is. The good news is that there’s a way to take your distributions a few years early without incurring this penalty. In addition, your modified adjusted gross income must be less than $146,000 to $161,000 (for single filers) or $230,000 to $240,000. A 401 (k) early withdrawal is any money you take out from your retirement account before you’ve reached federal retirement age, which is currently 59 ½. Unless you elect otherwise, benefits under a qualified plan must begin within 60 days after the close of the latest plan year in which you: A penalty tax usually applies to any withdrawals taken before age 59 ½.

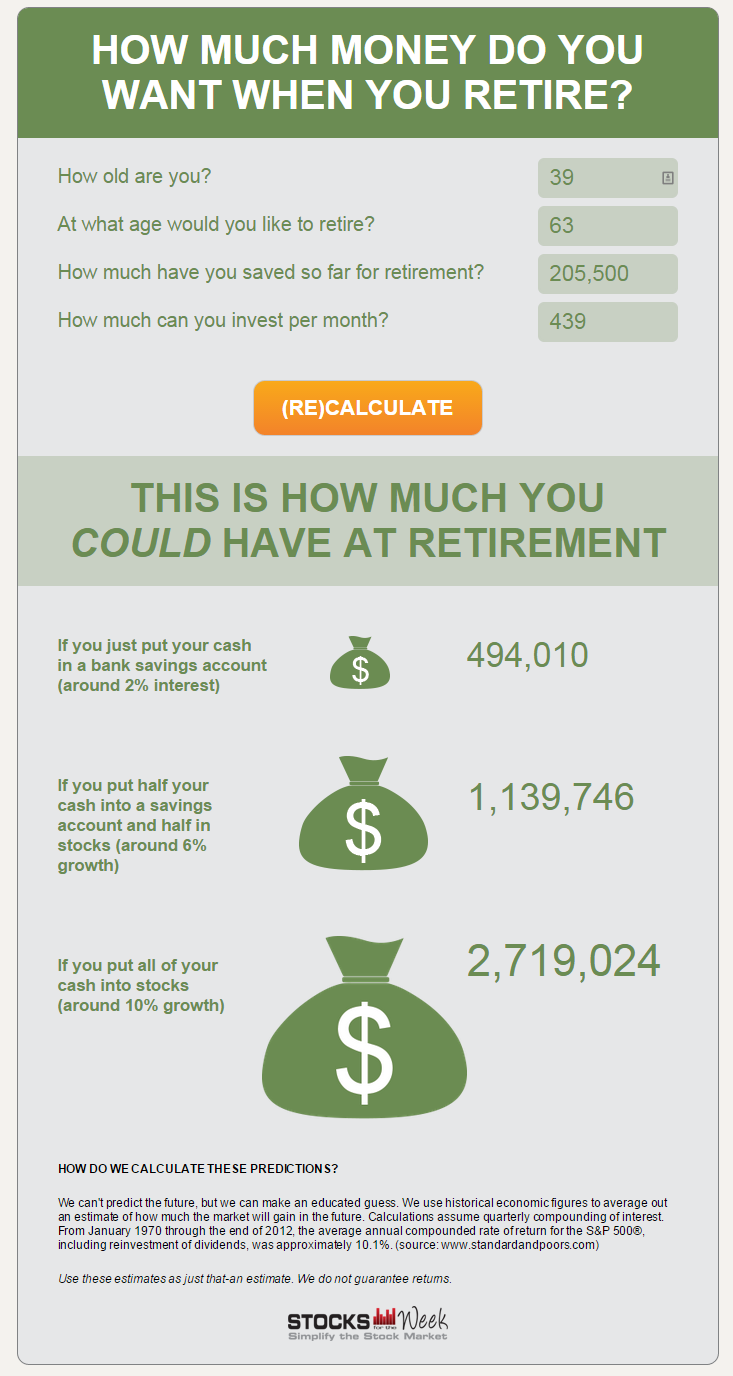

How to Estimate How Much Your 401k will be Worth at Retirement

:max_bytes(150000):strip_icc()/how-to-take-money-out-of-a-401k-plan-2388270-v6-5b575ead4cedfd0036bbfb6f.png)

Can I Borrow Against My 401k To Start A Business businesser

at what age do you have to take minimum distribution from a 401k Hoag

Web Those Limits Are Up From Tax Year 2023.

Some Reasons For Taking An Early 401.

If You Tap Into It Beforehand, You May Face A 10% Penalty Tax On The Withdrawal In Addition To Income Tax That You’d Owe On Any Type Of Withdrawal From A Traditional 401 (K).

Web The Median 401 (K) Balance For Americans Ages 40 To 49 Is $38,600 As Of The Fourth Quarter Of 2023, According To Data From Fidelity Investments, The Nation’s Largest 401 (K) Provider.

Related Post: