Age You Can Draw From 401K

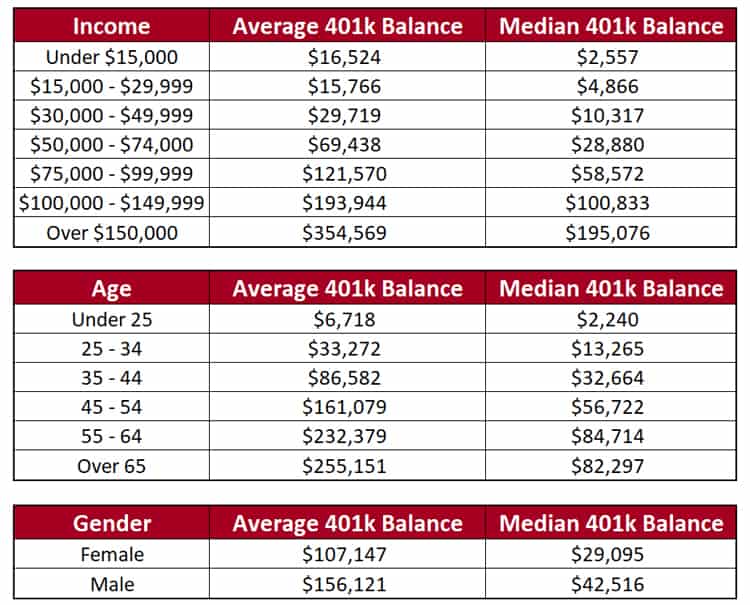

Age You Can Draw From 401K - Web you can make a 401 (k) withdrawal at any age, but doing so before age 59 ½ could trigger a 10% early distribution tax, on top of ordinary income taxes. Web this means you can contribute up to $30,500 for the full year if you meet the age requirements. Web you reach age 59½ or experience a financial hardship. In certain circumstances, the plan administrator must obtain your consent before making a distribution. Written by javier simon, cepf®. Be at least age 55 or older. Did you inherit an ira that you're looking to withdraw from? The rule of 55 applies only to your current workplace retirement plan and. Early withdrawals occur if you receive money from a 401 (k) before age 59 1/2. See the rules and how missing an rmd can bring stiff penalties. Let's assume that you're able to sock away a hefty $25,000. Early withdrawals occur if you receive money from a 401 (k) before age 59 1/2. Web the rule of 55 is an irs provision that allows those 55 or older to withdraw from their 401 (k) early without penalty. Those who are 70 can collect up to $4,873. The. Web this means you can contribute up to $30,500 for the full year if you meet the age requirements. Web still, those with a full retirement age of 67 can boost their monthly payment by 24% by waiting until 70. Periodic, such as annuity or installment payments. In most, but not all, circumstances, this triggers an early withdrawal penalty of.. In certain circumstances, the plan administrator must obtain your consent before making a distribution. Web the approximate amount you will clear on a $10,000 withdrawal from a 401 (k) if you are under age 59½ and subject to a 10% penalty and taxes. Web here's a common scenario: The rule of 55 applies only to your current workplace retirement plan. For instance, your age affects when you may: Under particular circumstances, you can withdraw from a 401 (k) between 55 and 59½ without being penalized. The median 401 (k) balance for americans ages 40 to 49 is $38,600 as of the fourth quarter of 2023, according to. Web updated on december 14, 2023. In certain circumstances, the plan administrator must obtain your consent before making a distribution. Web you’re age 55 to 59 ½. If you tap into it beforehand, you may face a 10% penalty tax on the withdrawal in addition to income tax that you’d owe on any type of withdrawal from a traditional 401 (k). Web however, you may need to take some proactive steps in order to retire comfortably. Periodic, such as annuity or installment payments. Web you can make a 401 (k) withdrawal at any age, but doing so before age 59 ½ could trigger a 10% early distribution tax, on top of ordinary income taxes. Edited by jeff white, cepf®. Web you generally must start taking withdrawals from your 401 (k) by age 73 but can avoid this requirement if you’re still working. Have a 401 (k) or 403 (b) that allows rule of 55 withdrawals. The best idea for 401(k) accounts from a previous employer is to roll them over when you leave a job. You earn a certain sum, and the amount you can contribute to your retirement account(s) is, naturally, limited. You've reached that magic age when the irs requires you to take annual ira withdrawals.

401k Savings By Age How You Should Save For Retirement

The Rise Of 401k Millionaires Living Large In Retirement

The Surprising Average 401k Plan Balance By Age

Web The Rule Of 55 Doesn't Apply If You Left Your Job At, Say, Age 53.

Early Withdrawals Occur If You Receive Money From A 401 (K) Before Age 59 1/2.

Web You Generally Must Start Taking Withdrawals From Your Traditional Ira, Sep Ira, Simple Ira, And Retirement Plan Accounts When You Reach Age 72 (73 If You Reach Age 72 After Dec.

Those Who Are 70 Can Collect Up To $4,873 In.

Related Post: