Age To Draw 401K

Age To Draw 401K - Web required minimum distribution calculator. Web required beginning date for your first rmd. Be at least age 55 or older. Have a 401 (k) or 403 (b) that allows rule of 55 withdrawals. But if you’re withdrawing roth funds, you may not have to pay taxes on your contributions. Web you can start receiving your social security retirement benefits as early as age 62. You can't take loans from old 401(k) accounts. There are some exceptions to these rules for 401 (k) plans and other qualified plans. Web you generally must start taking withdrawals from your traditional ira, sep ira, simple ira, and retirement plan accounts when you reach age 72 (73 if you reach age 72 after dec. In certain circumstances, the plan administrator must obtain your consent before making a distribution. The costs of early 401 (k) withdrawals. Web first, let’s recap: The approximate amount you will clear on a $10,000 withdrawal from a 401 (k) if you are under age 59½ and subject to a 10% penalty and taxes. If you delay taking your benefits from your full retirement age. Web you generally must start taking withdrawals from your traditional. Most plans allow participants to withdraw funds from their 401 (k) at age 59 ½ without incurring a 10% early withdrawal tax penalty. That’s the age that serves as a cutoff for having to pay early withdrawal penalties. Web you can make a 401 (k) withdrawal at any age, but doing so before age 59 ½ could trigger a 10%. However, you are entitled to full benefits when you reach your full retirement age. Web the median 401 (k) balance for americans ages 40 to 49 is $38,600 as of the fourth quarter of 2023, according to data from fidelity investments, the nation’s largest 401 (k) provider. Some reasons for taking an early 401 (k). Web those who contribute to. Most plans allow participants to withdraw funds from their 401 (k) at age 59 ½ without incurring a 10% early withdrawal tax penalty. Be at least age 55 or older. This is known as the rule of 55. Web you’re age 55 to 59 ½. If you delay taking your benefits from your full retirement age. Web updated february 09, 2024. A 401 (k) early withdrawal is any money you take out from your retirement account before you’ve reached federal retirement age, which is currently 59 ½. Gili benita for the new york times. In most, but not all, circumstances, this triggers an early withdrawal penalty of. Web you generally must start taking withdrawals from your traditional ira, sep ira, simple ira, and retirement plan accounts when you reach age 72 (73 if you reach age 72 after dec. The costs of early 401 (k) withdrawals. The approximate amount you will clear on a $10,000 withdrawal from a 401 (k) if you are under age 59½ and subject to a 10% penalty and taxes. Web when it comes to when you can withdraw 401(k) funds, age 59½ is the magic number. A 401 (k) loan may be a better option than a traditional hardship withdrawal, if it's available. If you’re contemplating early retirement, you should know how the rule of 55 works. Web for 2023, the age at which account owners must start taking required minimum distributions goes up from age 72 to age 73, so individuals born in 1951 must receive their first required minimum distribution by april 1, 2025.

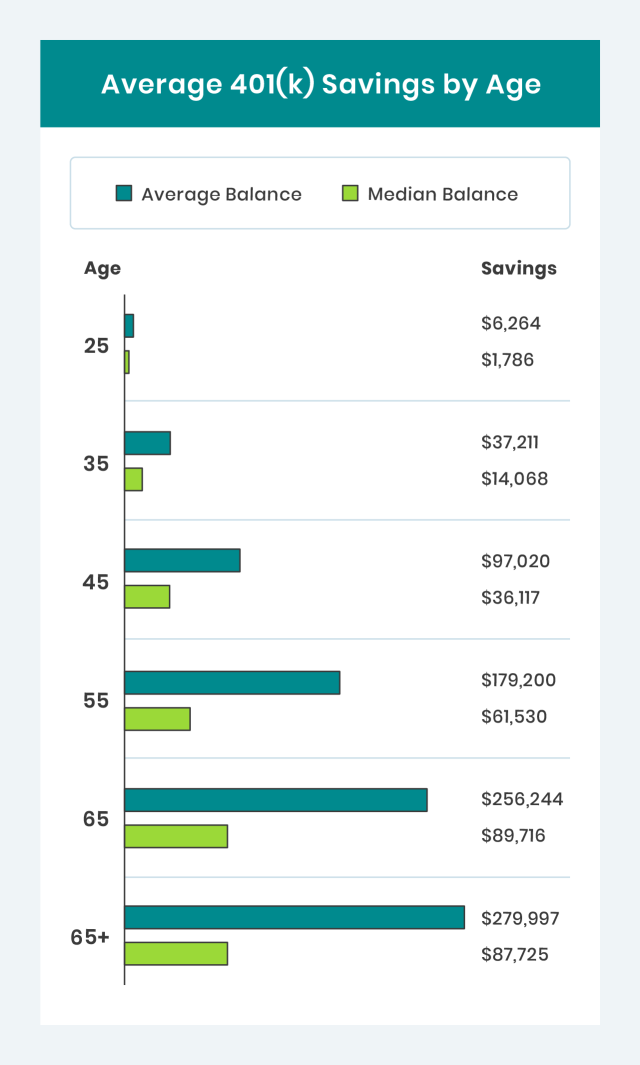

The Average And Median 401(k) Account Balance By Age

What is the Average 401k Balance by Age? (See How You Compare) Dollar

Average 401(k) Balance by Age Your Retirement Timeline

Web First, Let’s Recap:

But If You’re Withdrawing Roth Funds, You May Not Have To Pay Taxes On Your Contributions.

Web You Can Begin To Withdraw From Your 401 (K) Without Penalty When You Reach Age 55 Through Age 59½.

Explore All Your Options For Getting Cash Before Tapping Your 401 (K) Savings.

Related Post: