Age To Draw 401K Without Penalty

Age To Draw 401K Without Penalty - Web under normal circumstances, participants in a traditional 401 (k) plan are not allowed to withdraw funds until they reach age 59½ or become permanently unable to work due to disability, without. If you need to dip into a retirement account before you retire—whether it's a 401 (k), ira, or another type of plan—you might have to pay a penalty. Web the rule of 55 doesn't apply if you left your job at, say, age 53. But if you’re withdrawing roth funds, you may not have to pay taxes on your contributions. Learn about opening and contributing to a 401(k) workplace savings plan. (these are called required minimum distributions, or rmds). For example, you won’t be able to withdraw your roth 401(k) contributions until age 59½ or you experience another qualifying event such as disability, termination of employment, financial hardship, or death. Generally, if you withdraw money from a 401 (k) before the plan’s normal retirement age or from an ira before turning 59 ½, you’ll pay an additional. But there are a few ways to avoid the penalty. Web you’re generally charged a 10% penalty by the internal revenue service (irs) on any withdrawals classified as early—on top of any applicable income taxes. Has set the standard retirement age at 59 ½. Web under normal circumstances, participants in a traditional 401 (k) plan are not allowed to withdraw funds until they reach age 59½ or become permanently unable to work due to disability, without. With the rule of 55, those who leave a job in the year they turn 55 or later can. Generally, if you withdraw money from a 401 (k) before the plan’s normal retirement age or from an ira before turning 59 ½, you’ll pay an additional. Usually, the answer to that is no. However, that doesn’t mean there are. If you tap into it beforehand, you may face a 10% penalty tax on the withdrawal in addition to income. Generally, if you withdraw money from a 401 (k) before the plan’s normal retirement age or from an ira before turning 59 ½, you’ll pay an additional. Web tapping into your 401(k) before hitting 59 and a half years can lead to hefty taxes and a 10% penalty, but exceptions exist. Learn how to get your retirement money early. Web. Someone turning 70 this year would have been born in 1954, giving them a full retirement age of just 66. The approximate amount you will clear on a $10,000 withdrawal from a 401 (k) if you are under age 59½ and subject to a 10% penalty and taxes. You can withdraw money from your 401 (k) before 59½, but it’s. Web updated on february 15, 2024. You can't take loans from old 401(k) accounts. Web most plans allow participants to withdraw funds from their 401 (k) at age 59 ½ without incurring a 10% early withdrawal tax penalty. Web you generally must start taking withdrawals from your traditional ira, sep ira, simple ira, and retirement plan accounts when you reach age 72 (73 if you reach age 72 after dec. Web the irs dictates you can withdraw funds from your 401 (k) account without penalty only after you reach age 59½, become permanently disabled, or are otherwise unable to work. There are some exceptions to these rules for 401 (k) plans and other qualified plans. Web 401(k) withdrawals after age 59½. This is known as the rule of 55. For example, you won’t be able to withdraw your roth 401(k) contributions until age 59½ or you experience another qualifying event such as disability, termination of employment, financial hardship, or death. Once you reach 59½, you can take distributions from your 401(k) plan without being subject to the 10% penalty. However, that doesn’t mean there are. Understanding the rules about roth 401 (k) accounts can keep you from losing part of your retirement savings. If you’re contemplating early retirement, you should know how the rule of 55 works.

How To Pull Money From My 401k

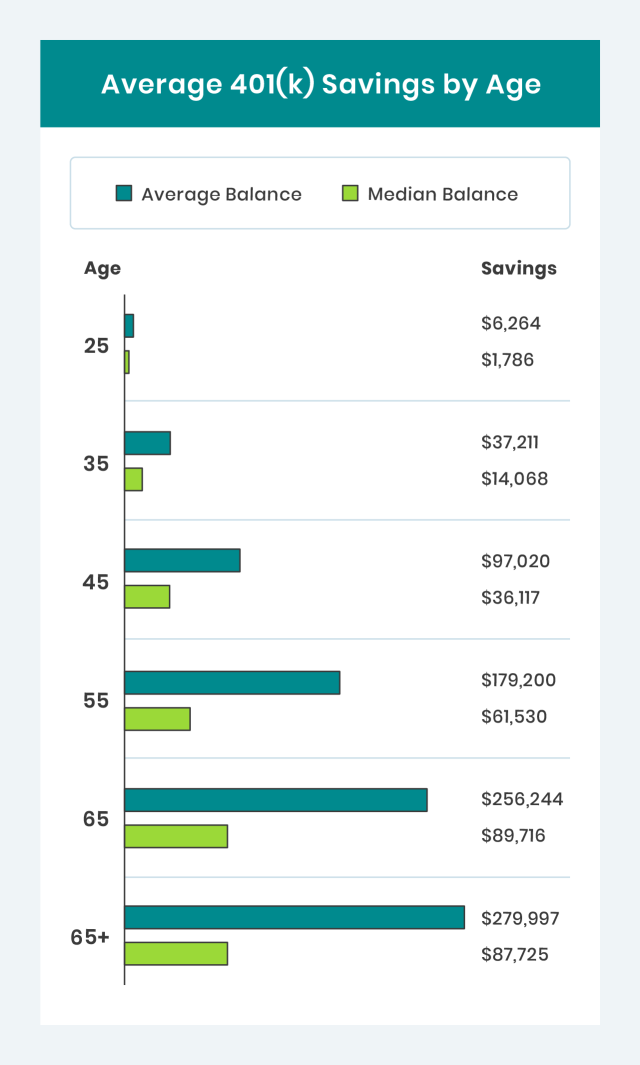

What is the Average 401k Balance by Age? (See How You Compare) Dollar

Average 401(k) Balance by Age Your Retirement Timeline

Web Under Particular Circumstances, You Can Withdraw From A 401 (K) Between 55 And 59½ Without Being Penalized.

Jayla Could Have $547,638 By Retirement Age, Over $300,000 More Than What Hannah Might Have.

Web The Rule Of 55 Would Allow You To Take Money From Your 401 (K) Or 403 (B) Without Having To Pay The 10% Early Withdrawal Penalty.

Web Under Normal Circumstances, Participants In A Traditional 401 (K) Plan Are Not Allowed To Withdraw Funds Until They Reach Age 59½ Or Become Permanently Unable To Work Due To Disability, Without.

Related Post: